A Banner Year for Vertical Software

But Early-Stage Investment Still Lags

We founded Euclid because we believe we are in the early innings of an inevitable transformation resulting in every vertical of the economy being powered by its purpose-built constellation of software. With most of the M&A and fundraising data for 2024 now available, we wanted to share a few updates on some of the top-level metrics we track around the growth of the category.

Vertical Software Exit Share

For the first time, vertical software is driving the majority of B2B SaaS exits, representing 52% of the exit volume, up slightly from 49% the previous year.

Since 2020, vertical software has been generating an average of $90B in exits each year. As we have discussed at length in prior essays (e.g., here and here), we expect this volume to grow over the coming decade.

Founder-Market Fit Analysis

We have also discussed at length our conviction—informed by our collective 25+ years of first-check investing in the space—that founder profile is one the foremost ingredients to vertical software success. That is why at Euclid we focus on backing founders with demonstrated, deep connectivity to their vertical, usually from sector-specific experience from past startups or industry roles.

Our updated founder background analysis, now including 2024 exits, only strengthens the argument. Teams with founder-market fit (identified here as having one founder with ties to the target vertical) drive 91% of all vertical software exits.

Vertical Software at the Series A

For the new year, we’re adding one additional analysis tracking the Series A fundraising market for vertical software.

As you can see in the above chart, vertical still lags meaningfully behind non-vertical, at least at Series A. In total, 33% more horizontal companies raised Series As in 2024, pulling in 65% more dollars in aggregate. In total, vertical software represents 38% of B2B Software Series A dollars raised.

In an efficient market, one might expect the vertical share of Series A dollars to rise from here, approaching the ~50% share of exits over time. And indeed, we are seeing a meaningful near-term driver for increased VC interest in vertical software: generative AI. As we discussed in a previous essay, we believe that vertical software applications will be a significant near-term application layer “winner” of the upcoming LLM cycle. The market is showing clear interest in the theme, from various LLM-driven vertical wedges (e.g., EvenUp, EvolutionIQ, Abridge) to AI-first roll-ups.

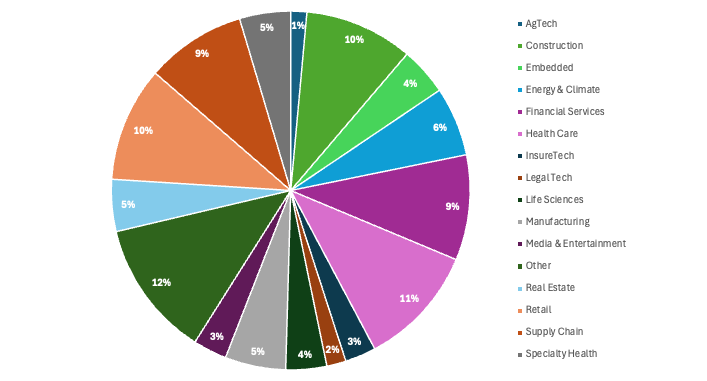

Double-clicking into the vertical Series A market, we broke out dollars invested by vertical to get a sense of where investor interest is concentrating. The largest five categories are Healthcare (11%), Construction (10%), Retail (10%), Supply Chain (9%), and Financial Services (9%).1

We look forward to seeing the continued rise of vertical software and the market in 2025—hungry for AI yet starved for liquidity—as a whole.

As always, thanks for reading Euclid Insights. If you’re a founder or VC with thoughts on the vertical software exit or fundraising environment, we’d love to hear from you via email, LinkedIn, or the comments below.

Sources for all data: Crunchbase, Pitchbook, & Euclid Analysis (2024).