The State of Vertical AI (Q1)

Abridge, Hippocratic, Freed, Flock Safety, Shield AI, BuildOps, and more

Abstract

+ Q1 2025 saw $10.4B in vertical funding over 552 deals

+ Vertical represented a 42% share (by dollars)

+ Spike in early-stage deals in Hospitality and Manufacturing

+ Thematic deep dive: Healthcare AI (Abridge, Freed, Lila, OpenEvidence)Despite Vertical AI’s ascendancy over the past year, there are few data-driven resources out there for founders, investors, and operators tracking the contours of its progress. In fact, none, by our measure. With today’s post, we hope to change that.

Beyond centralizing the data, our aim is to provide a retrospective analysis, give a sense for Vertical AI is headed, and offer one thematic takeaway per edition drawing on our roadmaps at Euclid and what we’re seeing in the market.

I. Financing

Summary

Q1 2025 saw $10.4B in vertical software financings in the US and Canada.1 These 552 deals represented 40% of relevant raises by volume and 42% by dollars. Vertical rounds concentrated at the early growth stage, with ~30% of dollars falling into the later-stage category vs. just under 20% for horizontal.

Of rounds >$10M and >$50M, vertical share was 37% and 35%, respectively—more or less in-line with overall share. The quarter saw several emerging Vertical AI leaders catapult into unicorn status (or bolster their pre-existing $1B+ valuations). The largest round belonged to NinjaOne, which raised a $500M late growth round to accelerate its push from its SaaS roots into AI. But perhaps more telling were raises from several Vertical AI high-flyers in the $2-8B post-money range, including Flock Safety, Abridge, Innovaccer, and Shield AI. We also saw several recent vertical unicorns raise—both new and familiar names—including Lila Sciences, OpenEvidence, BuildOps, Augury, and Hippocratic AI.

Vertical activity still lags its ~50% share of B2B software exits, as discussed in past essays. In this current era of AI, however, this is no surprise to us—in fact, it’s possible we see more over-weighting toward horizontal than less in the VC financing data through 2025, as larger funds look to king-make in what they perceive to be binary foundation-layer winners. The numbers, however, demonstrate a clear vote of conviction behind the ability of Vertical AI platforms to capture their industry segments and build IPO-scale businesses, regardless of the outcome in the race to dominance in categories like generalist AI, coding agents, or no-code app creation.

Overall, Q1 2025 saw strong investor enthusiasm for Vertical AI, highlighting increased focus on LLM-driven solutions that deliver net-new value-propositions over traditional SaaS across industries of the economy. The above chart (shown on a log-log basis for visibility) highlights the particular maturity of Healthcare AI—the theme of our deep-dive this edition, below.

The next wave comprised financial services, supply chain, energy, and insurance2—in our view, all categories piggybacking on continued capital momentum from 2018-2022 era. Construction and legal showed signs of both growing maturity and deal appetite. Perhaps most interestingly, a few categories demonstrated notable spikes in deal activity at the early-stage: hospitality (including restaurants, travel, and hotels) and manufacturing both clocked 20-30% of their deal volume in the $1-5M range. Education and media & entertainment were not far behind, with around 10% overweighting toward seed-type raises.

Retail & CPG stands out as a vertical worth tracking, with relatively high deal volume in comparison to dollars invested. Removing GrubMarket—a very late-stage deal with non-traditional backers—the category demonstrated strong early-stage appetite with 20 sub-$15M deal. This quarter, Greylock backed Highstock and Energize backed Archive. Both are building around what we see as big, underserved economic and societal problems around retail distribution, inventory, access, and waste. We also saw peripheral vertical plays touching on this issue, including Euclid’s own Frontier Risk (which approaches CPG from the insurance angle) and Odeko (which addresses inventory challenges for cafes).

The clear winner in Q1 2025, however was healthcare. We have always felt healthcare is better viewed as 10+ sub-categories rather than one monolithic vertical. So it’s no surprise its deal sizes and volumes overshadow the pack. But healthcare AI stood out in more ways than one this quarter.

Vertical Highlight: Healthcare

Healthcare captured 26% of all vertical financing dollars and >30% of large deals ($50M+ rounds) this quarter, for a total of $2.7B in capital raised across 152 deals.3 The quarter saw several large rounds, many of which sat at the intersection of healthcare and other categories like education, life sciences, and climate.

Abridge raised $250M in a Series D led by IVP and Elad Gil, and joined by Lightspeed, CVS, Redpoint, NVentures (NVIDIA’s VC arm), and early backers BVP and USV. Founded in 2018, Pittsburgh‑based AI startup was early to the AI-native healthcare game. Automating the generation of clinical notes from doctor‑patient conversations and data interface with EMRs, the company has leaned heavily into ecosystem partnership strategies, including seed investor UPMC (amongst ~100 other health systems at this point) and EHR titan Epic Systems. This fresh capital follows a $150M round in 2024 that valued the company at $850M. Amongst other things, Abridge will use these funds to bolster its proprietary AI (e.g. its new Contextual Reasoning Engine). Along with Freed, Abridge is one of the foremost standard-bearers of Vertical Voice AI, a theme we’re bullish on at Euclid and have covered extensively.

Freed raised $30M in a Series A led by Sequoia in March 2025, with support from prior lead Scale, and luminary angels Daniel Gross and Gokul Rajaram. The clinician-centric AI platform was founded in 2023 by a husband-wife team: former Meta engineer Erez Druk and physician Gabi Meckler. With ~$35M in funding since its launch, Freed has onboarded 20k+ paying clinicians across 650+ orgs and 96 specialties. The fresh capital will accelerate Freed’s expansion beyond note writing—rolling out specialty‑specific templates, pre‑charting, and deepening EHR integrations. Freed is extremely interesting as a side-by-side case study to Abridge. If Abridge is the top-down enterprise play, Freed champions the PLG healthcare AI approach—with entry pricing of $99 / mo and clinician-first, solo-practitioner-friendly positioning. It’s a great reminder that in AI, multiple paths to market can work—and that in big categories and functions, there is likely room for multiple big winners.

Lila Sciences raised $200M in March, led by Flagship Pioneering and joined by General Catalyst, March Capital, and others. Founded within Flagship’s labs in 2023—like Moderna before it—Lila aims to create “scientific super-intelligence,” integrating AI with autonomous lab system to designs and execute experiments. It’s as much a life sciences deal as healthcare, but given scale we had to include.

OpenEvidence raised $75M in a Series A led by Sequoia in February, joining the growing ranks of healthcare AI unicorns. The startup’s “ChatGPT for doctors” is trained on 35M+ peer‑reviewed publications, with a strategic partnership with the New England Journal of Medicine. Founder Daniel Nadler has some experience in data-driven AI product, having previously sold Kensho to S&P for $550M. OpenEvidence claims it is already used by 25–40% of U.S. doctors.4

Fay raised $50M in a round led by Goldman Sachs in February, with General Catalyst and Forerunner joining. It’s one we’ve tracked closely given its position at the intersection of AI care orchestration and the boom in “Synthetic Rollups” (or MSO-like plays) from the likes of Grow, Moxie, or in some ways, Euclid’s own Indie Health. Fay connects users with registered dietitians through an AI‑powered platform streamlining scheduling, claims, and care. Its network includes >2k RDs and payors like United, Aetna, Cigna, and Humana.

KODE raised $27M from Noro‑Moseley in January, with Mercury, FCA, and others joining. We see it as an interesting case study in the AI-driven evolution of business models. The startup offers an on‑demand medical‑coding marketplace connecting hospitals to certified “Koders,” with the aim of improving revenue cycle. While pure AI replacement of labor is not the sole value prop here, KODE uses AI to streamline billing and admin work—“dogfooding” AI internally to drive outcomes. It’s perhaps also a relevant example of an emerging Euclid thesis around the promise of AI to reduce the complexities of managing and scaling a marketplace or network-driven business (more on that in an upcoming essay).

Assort Health raised $22M from First Round, Chemistry, and Quiet. Some might say it reflects a “down the middle” play in healthcare AI today: bringing productivity to administrative labor. Assort develops voice agents managing front-of-house operations—inbound calls, triaging, scheduling, care navigation—for clinicians and systems. Chemistry’s Ethan Kurzweil said they “8x’ed revenue since Q4 2024,” having handled millions of calls to date.5 Yet another example of the explosive growth potential of Vertical Voice AI.

Deal Highlight: BuildVision

AI in construction & trades also saw a compelling quarter: growth-stage notables like Motif and Stratus were paired with a bloom of Series As (24 deals in the $1-15M range altogether).

Amongst that Series A cohort, was Euclid portfolio company BuildVision. The team raised a $10M round led by our friend Sean Jacobsohn at Norwest Ventures. Traditionally, large owners and general contractors (GCs) relied on local subcontractors and distributors to source engineered building systems: a fragmented, inefficient process that added unnecessary markups and delays to hundreds of millions worth of procurement. BuildVision’s network connects GCs directly with manufacturers and suppliers, while its AI tooling automates much of the manual back-and-forth of procurement—ingesting and normalizing PDFs, product specs, and other unstructured data.

BuildVision was born out of extreme founder-market fit. Founders Mike Powers and Christophe Prakash were both early BuildingConnected employees. BuildingConnected (BC) was the pioneer of pre-construction GC-sub network management, and was ultimately acquired by Autodesk. Before his time at BC, Mike spent his early years at Turner Construction—the largest domestic general contractor—as a specialists in the management of equipment procurement.

In addition to being a notable deal this quarter, BuildVision offers a great case study on how the current generation of AI is creating value where traditional SaaS struggled. The GC procurement process is complex, involving hundreds of 1-1, human-driven workflows across disparate stakeholders. Individually, the decisions may not be Herculean—but in aggregate they require head-counts in the hundreds. In this case, streamlining and documenting the work is table stakes. The prize lies in execution automation, which AI has never been better suited to perform.

II. Exits

While this quarter was dominated by the $10B+ buyout of Altair Engineering by Siemens and the acquisitions of platforms that had already traded hands, we will highlight one deal: EvolutionIQ.

We see EvolutionIQ as one of the first in a coming wave of strategic, relatively early acquisitions of Vertical AI by incumbents. In January, CCC Intelligent Solutions ( a public business in the insurance space) acquired EvolutionIQ for $730M. The New York-based AI-powered claims fraud detection platform company was founded in 2019 by Jonathan Lewin, Mike Saltzman, and Tom Vykruta. Its claim guidance software uses AI to detect fraud, improve claims processing, and track productivity for insurance companies, with beachheads in the disability and workers' compensation markets.

EvolutionIQ raised just over $60M since inception across multiple funding rounds, including its $20M million Series C in July 2024. That raise valued the company at $595M, with backing from investors including Foundation, FirstMark, First Round, Guardian Life Insurance, Brewer Lane Ventures, and Asymmetric. The acquisition gives CCC a foothold in AI while driving big potential margin potential around its existing claims resolution offerings.

We don’t see any overwhelming signal in the vertical mix of exits this quarter, especially given the skew towards large transactions. We have, however, listed some noteworthy trades in each vertical below.

III. Public Markets

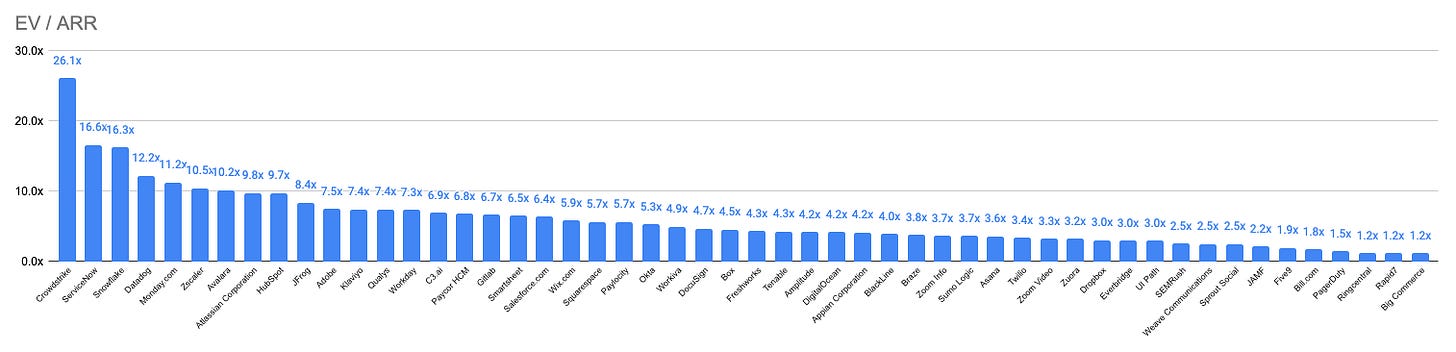

In future editions, we will highlight trading trends from quarter-to-quarter and key filing / research highlights. For our inaugural report here, we’ll just stick to the data:

Thanks for reading Euclid Insights! If you know a founder thinking through an idea Vertical AI, or trends in vertical markets generally, we’d love to help. Please reach out to us here (DM or in comments below) or on LinkedIn.

We define these as venture-backed software and software-driven healthcare rounds, with targets based in the US & Canada and a minimum raise of $1M. We excluded 3 generalist foundation model outliers: OpenAI ($40B), Anthropic ($5.25B), and Groq ($1.5B)

Insurance had $448M in VC raised over 30 deals in Q1. It is obscured by the Energy data point on the chart.

These figures exclude life sciences, which we carve out into its own category.

Wheatley (2025). OpenEvidence raises $75M to become the ChatGPT for doctors. SiliconAngle.

Kurzweil (2025). Our first live investment. LinkedIn.

This piece has nothing to do with Voice AI!

Great to see attention on voice AI in healthcare. ASR still faces tough challenges in noisy, high-stakes environments—especially with diverse speaker profiles.