Market Sizing in Vertical AI (Part II)

The Power of Starting Small: ACVs, Beachheads & Wedges

In Part I of our essay on market sizing in vertical software, we shared a baseline definition of TAM and detailed flaws in the common generalization that venture-scale businesses need to start with massive markets. First, we found that ultimate TAMs are extremely difficult to define with any resolution at the earliest stages of a business. Second, beyond a certain floor—say $100M for a beachhead or $5B at IPO scale—a team’s ability to grow TAM over time is much more deterministic of success than any point-in-time, discrete calculation of market size.

In today’s Part II, we will take this analysis to a more pragmatic level, arming vertical software founders with tools to evaluate their own TAM and expansion strategy:

ACVs & Customer Counts: First, we share a deep dive on ACVs and customer counts, both of which feature heavily in the narrative of “how big a company can get.” We dispel a few more VC mysticisms along the way.

TAM Expansion Strategy: Second, we introduce our view on how opportunity expansion has fostered incredibly successful platforms at scale. We detail common vectors of expansion and what that means for selecting effective wedge products at the early stage.

Hyper-Focus at the Early Stage: Armed with these insights, we conclude with a message to early-stage vertical software founders on the benefits of constraining the scope of your initial target market. At Euclid, we believe a narrow focus early is critical to effective customer discovery, mindshare capture, and speed-to-PMF.

Optimizing ACVs & Customers Counts

The ACV (Annual Contract Value)1 of a software business is typically used as a proxy for the value a startup can deliver to and hence earn from its customers. It is also a core component and the easiest way to calculate market opportunity: ACV * potential customers. A high ACV business might be asked about its sales cycles, given its customers are more likely to be on the enterprise side. A low ACV business might be asked about its CAC (constrained by revenue per customer) or ICP (as it requires many more customers to get to scale).

This area of inquiry is important for vertical software founders because they often face TAM skepticism emanating from low initial ACVs and / or the number of prospective customers. In Part I of this essay, we discussed how relevant customer sets are challenging to pin down at the early stage and how they often naturally grow over time. Similarly, some investors may believe big companies need big ACVs. To examine this question, we analyzed a data set of ~100 public horizontal and vertical software businesses. Considering the basic TAM calculation (ACV * customers), it’s no surprise that a scatter plot by ACV and customers looks like a reverse hockey stick (we show it in the log-log below for visibility).

Big software companies, in other words, need either a lot of customers or high revenue per customer, and they rarely have both. Palantir, for example, has fewer than 1000 customers—quite rare amongst our data set but sensible once you consider their extremely high average ACVs. On the other end of the spectrum, Intuit has over 100m customers with an ACV of $250. Interestingly, the relationship of customer count to ACV follows an inverse power-law. ACVs, in other words, grow at a better-than-linear rate as customer counts increase. This model would predict, for example, that a public software business with half the customer count would have a 72% higher ACV.

Eyeballing the dataset, there seem to be three “zones of concentration” in terms of ACV-customer balance: $500k-1m ACV / 1-2k customers (e.g. Palantir, Veeva, Guidewire, Trade Desk, Manhattan Associates), $50-100k ACV / 10-50k customers (e.g. Samsara, Datadog, Appfolio, Procore), and a smaller one around $5-15k ACV / 200-500k customers. That high ACV zone is dominated by vertical businesses, which to us makes sense: the deeper the focus, the more value capture and ACV expansion is possible. Conversely, an Intuit-type model requiring hundreds of millions of users would be difficult to contemplate in most verticals.

The most important takeaway from this exercise, in our mind, is that no significant correlation exists between either ACV or number of customers and Enterprise Value. Contrary to the line of thinking that vertical plays can’t capture massive user bases, Autodesk, Shopify, and LegalZoom all have >1M customers, while others like Toast and CoStar are not far behind. While vertical businesses feature more heavily in the high-ACV cluster, outlier horizontal businesses like ServiceNow, Workday, and Snowflake prove it is possible to go both broad and deep. Put simply, both high- and low-ACV models can support IPO-scale horizontal and vertical software companies. What’s more, high-growth, venture-scale wins can be found anywhere along the spectrum, from Veeva and Palantir on one end, to Toast and Shopify on the other, with Samsara and Gitlab in the middle.

So, what does this tell us about market sizing? If nothing else, that no one should discount a particular strategy due to its ACVs or customer counts in isolation. To be clear, we’re not saying that any strategy can work—there is massive selection bias in this dataset, given all included companies are post-IPO. With an absolutel max of 10k buyers, a $7k ACV isn’t going to cut it for a venture-scale outcome, and vice versa. A $7k ACV, however, may be sufficient for an early-stage wedge product that wins the right to grow into a $70k ARPA platform over time—that is more or less the ServiceTitan story. As discussed in Part I of this essay, the ability to grow TAM is significantly more important than any static measure. It makes sense then that founders should stress test their plan for growing ACV and / or customer count—TAM’s core constituents—and master articulation of that vision.

A Framework for Vertical TAM Expansion

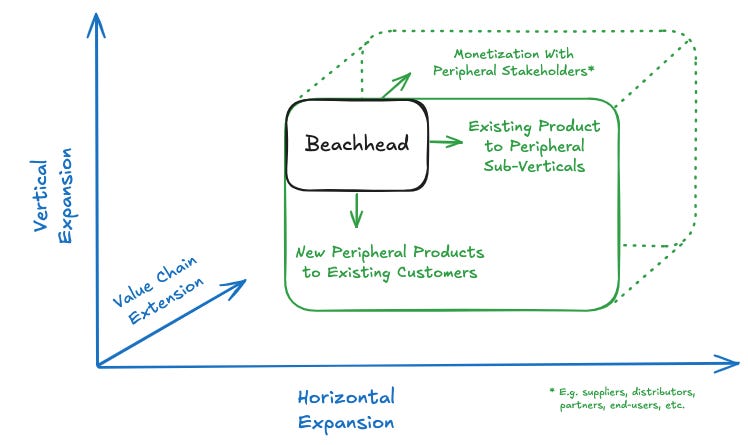

At the end of Part I, we shared a framework that we use at Euclid to map out a vertical software startup’s market opportunity at early stages. As you can see in the visual below, it considers the three primary axes of TAM growth:

Vertical Expansion:2 Growth by selling net-new products into your existing industry/customer base. An example of vertical expansion would be ServiceTitan selling financial services & marketing tools into HVAC trades to supplement its core ERP-light product.

Horizontal Expansion: Growth by selling existing product lines into net-new customer verticals. An example of horizontal expansion would be Mindbody selling its business management suite into salons beyond its initial beachhead in yoga and pilates studios.

Value-Chain Extension: Growth by selling into ecosystem partners of current customers (suppliers/distributors upstream, customers or their end-users downstream). This axis is a bit of a hybrid between vertical and horizontal expansion: it’s a net-new ICP, and usually requires a new product (or tailored version), but leverages traction to grow within the same core industry universe. This vector is often only feasible following PMF on initial products (Series A+) but can yield substantial network effects if successful. An example of value-chain extension would be Shopify’s offerings to 3PL partners or its consumer-facing Shop app.

Below, we illustrate how one might apply the framework to a handful of at-scale vertical software businesses. For clarity, these aren’t exhaustive—all of these, for example, would include payments in the vertical expansion list. As many as 30% of vertical SaaS companies that don’t start with payments will add it over time, making it almost certainly the most popular vertical expansion modality. Marketing (including ads or lead gen) or marketplace offerings were also popular over the last decade.3

Horizontal expansion, naturally, is much more idiosyncratic to a startup’s industry universe. While we don’t have the data offhand, we expect there is an inverse correlation between ACV and horizontal expansion activity. Mindbody and ServiceTitan, for example, have aggressively added new verticals over time; Veeva and OpenGov have not added so much. Value-chain extension has similar dynamics, perhaps with even fewer examples, given the strategy is best executed by players with pre-existing scale in their vertical.

This framework can be a helpful tool for mapping out the players in your addressable ecosystem, their needs, and the products that may leverage your initial PFM to grow TAM into new dimensions over time. In many ways, you can think of this graphic as being aligned with a smart customer discovery process. Vertical software businesses have natural advantages in “3D versus 2D” expansion, as Jackie DiMonte put it.4 However, many factors go into articulating the long-term opportunity as credible. In a future post, we will address these various elements of lifecycle market-size expansion: what products make the most sense when, when growth to adjacent sub-industries works or fails, the pros and cons of launching transactional revenue streams on top of SaaS (or vice versa), etc.

For today, however, we will conclude by speaking to what matters most to current and future Euclid founders: where to place that initial box. In other words, beachhead market and wedge product selection at the inception-stage.

The Value of a Hyper-Focused Beachhead

The following adage, attributed to Gmail creator Paul Buchheit, is one of the few startup sound bites we believe deserves its ubiquity:

It's better, initially, to make a small number of users really love you than a large number kind of like you.5

As mentioned in our past essays on what we look for in founders at Euclid (Part 1 and Part 2), obsession with the mindset and workflow of the customer is critical. Understanding what the customer is trying to achieve and why takes a high degree of focus, consistency, and intellectual honesty. Being too prescriptive about the value proposition you envisioned is dangerous. Successful founders—even those with first-hand experience in the vertical—must spend the time to understand how software can be built around the work to be done.6

Pre-G2M customer discovery will be unproductive if your funnel stays so wide that the work to be done varies too widely. Worse yet, getting drawn in several different directions once MVP development begins poses the risk that you fail to solve a #1 issue for anyone at all. We envision the process somewhat like this figure below (promise the Erlenmeyer flask resemblance was unintentional):

Finding a narrow beachhead ICP and wedge is an iterative process, triangulating what the customer will immediately adopt, what you can build quickly, and the attractiveness of that wedge to support a large business down the road. Even monetization at this stage is discovery—a dynamic test of willingness to pay. But just as you should always be learning from customers, you should always be selling. How else will you identify early adopters? If you’ve zeroed in on the right problem, you’ll find engagement even before MVP. And once you find your early-adopter ICP, make them zealots before widening the funnel. As Paul Graham aptly put it, “it’s like keeping a fire contained at first to get it really hot before adding more logs.”7

Focus at the earliest stages, however, does not mean blinders to the long-game. While the team can stay insulated, a CEO should always have an answer to the question “how does this grow into a $100m ARR business”… even if the resolution is low, there are several credible paths, and that answer changes along the way (it should and will). No early-stage VC wants to feel like a founder hasn’t thought through future states at length, or worse, get the impression that he / she is not determined to build a high-growth, venture-scale business.

We at Euclid value founders who can think big while starting small—which is harder than it sounds. If there is a common thread across all category-defining vertical software successes, this one makes a strong case.

Thanks for reading Euclid Insights! If you know a vertical software / AI founder thinking through their next idea, market, or wedge product, we’d love to be a sounding board—feel free to reach out via LinkedIn, Substack DM, or in the comments below.

For simplicity, we will use ACV here. Often, ARPA (average revenue per account) is a more valid and inclusive term, considering many vertical software businesses have multiple revenue streams beyond just subscription SaaS. Perhaps increasingly so, given the monetization innovation surrounding vertical AI.

ACV, customer count, and EV data from Pitchbook (2024). Exhaustive sources included in Part I of this essay, “Market Sizing in Vertical Software”:

These terms can be a bit confusing but recall that “vertical” and “horizontal” come from a business matrix that visualized products sold as rows and industries served as columns. So by launching net new products, you are moving vertically on that chart. By venturing into new industries, you are moving horizontally across that chart.

Yuan, Walsh, Mullin, Tan (2024). Tidemark Vertical & SMB SaaS Benchmark Report 2024. Tidemark Capital.

DiMonte (2024). Unlocking hidden value. Day by Jay.

Quote attributed to Paul Buchheit. Graham (2009). Five Founders. PaulGraham.com.

Graham (2013). Do Things That Don’t Scale. PaulGraham.com.