Swiss Cheese & Vertical Software

What aviation safety can teach us about early-stage risk

The reality is that most venture-backed startups fail. At least in the sense that they don’t grow large enough, fast enough and achieve an exit that generates substantial multiples on venture dollars invested. In our two-part essay on Market Sizing in Vertical Software, we shared our perspective that early-stage investors tend to drastically over-inflate the relative impact of initial TAM on outcomes, biased by a “great filter” for massive markets. Indeed, markets are a common company killer. To quote Andy Rachleff's Law of Startup Success: “When a great team meets a lousy market, market wins.”1

We haven’t been shy about our gripe with VC over-reliance on hazy market size estimations. “TAM too small,” of course, is the easiest way to exclude an opportunity and move on without having to do any work. More importantly, we think this deterministic, myopic approach to market analysis will miss many of the future significant outcomes that will emerge in Vertical AI.

To understand why, we want to introduce a heuristic for evaluating the conditions for vertical software success. That framework—or more accurately, that multi-variate risk assessment—is named after (you guessed it) Swiss Cheese.

Risk Assessment: Don’t Miss The Forest for the Trees

The Swiss Cheese Model originated with James T. Reason, a cognitive psychologist and professor emeritus at the University of Manchester, England, who introduced the concept in his 1991 book, Human Error. Motivated by evaluating a succession of disasters, including the Tenerife runway collision, the Three Mile Island accident, the Challenger shuttle explosion, and the Chernobyl disaster, Reason developed the concept of the Swiss Cheese Model of accidents.

The framework illustrates how catastrophic failures result from a combination of factors, rather than a single root cause. The model is visualized as a process progressing through a stack of Swiss Cheese, right to left:

The left-to-right axis is time, as the process is exposed to various elements of risk

Each layer of cheese is a discrete source of risk

The holes in each slice of cheese each represent a failure in that risk layer

If the process clears the whole stack without hitting cheese, effectively “threading the needle” due to unfortunate cheese-hole alignment, the result is a catastrophe

Failures in individual risk layers will never sink the ship… it is only the confluence of failures at many key layers that results in the worst outcomes

The Swiss Cheese model is a common framework in accident analysis and redundancy planning. While it began with aviation disasters, the paradigm has become widely adopted in engineering, healthcare, and other fields for risk assessment. Some astute observers may remember that a visual representation of how to prevent the spread of COVID-19 that went viral in 2020 was based on the Swiss Cheese Model.2

What does this have to do with startups or venture capital? Outlier outcomes in VC are, in effect, rare accidents. Why do they succeed? Ask any founder or VC and you’ll get a different answer. This is because there is no one answer. Startup success is a multivariate probabilistic consideration complex enough that AI has not yet put early-stage investors out of business. Like in catastrophe planning, it’s the big ones that matter—it’s a Power Law consideration. As we learned about the Swiss Cheese Model, these similarities (albeit in reverse) got us thinking. In disaster mitigation, they use the framework to think about how wrong builds upon wrong, creating a grim feedback loop that yields a horrible, unforeseen outcome. What if we, instead, flipped the model to think about startups: how does right turn into really, unbelievably right and a category-winning outcome?

Early-Stage Underwriting in Vertical Markets

When evaluating early-stage vertical startups, we find that investors often revert to a loss-aversion mindset, adopting the “what could go wrong” underwriting approach. Here, market size risk (for example) becomes the single point of failure in any analysis. The challenge with this approach is not just the imprecision of applying a fixed view of TAM too early (which we’ve written about ad nauseam), but also a fundamental oversimplification of the risks inherent in “a small market.”

Let’s return to the Swiss Cheese model to explain. Recall that if any two holes are misaligned, progress stops. For our purposes, that means the startup fails to achieve its rare end-state of success. Each condition (represented by a slice) can be grouped into one of two types:

Organizational: Internal factors, or those within the company's control.

Exogenous: Latent factors that the organization can influence but are not within direct control (e.g. tied to market forces).

Most investors would agree, there are a range of internal factors that matter, all of which have important constituent aspects: team, product, GTM, etc. With time being the rate-limiting-factor of most VCs, however, it’s sometimes necessary to get reductive. The easiest criteria to react on those that are most easily available—and these tend to be exogenous, as they don’t require much time with the founder / materials, and rely more so on what’s in one’s head. This generally explains why the low-resolution filter on “market” is so commonplace. The opportunity feels weak because the market feels weak—too small, tough, or slow—so why spend time on it?

The there are two major issues with this approach. The first is that this particular filter, in our view, is an easy one to get wrong. Around 1970, economists Amos Tversky and Daniel Kahneman studied mental shortcuts people use when judging uncertain events.3 In a 1973 paper,4 they coined the "availability heuristic," wherein individuals judge the likelihood of events based on how easily examples come to mind. For example, people tend to assume there are more English words beginning with "k" than words with "k" as the 3rd letter, merely because it is easier to bring to mind the former.5 Availability bias plagues venture underwriting. Despite our best efforts, it is extremely difficult for most people not to judge likelihood of success based on the number of similar stories they can easily recall—which, of course, are based on historical circumstances rather than future (a problem for investors).

The second, and perhaps more important, issue is this: early-stage VC is about picking winners, not avoiding losers. There are a million reasons why a startup can fail… after all, the vast majority do. Identifying a failure point is not hard. It follows then that underwriting should be concerned primarily with evaluating the prospective conditions required for a winner to emerge: how could this go right? And the success of that low-probability success event—per our Swiss Cheese model—is multivariate by nature.

Even TAM itself is not an atomic criterion. We shared a tongue-in-cheek take last week that the “TAM” founders and their investors should worry about most is 𝘛𝘰𝘵𝘢𝘭 𝘈𝘵𝘵𝘢𝘪𝘯𝘢𝘣𝘭𝘦 𝘔𝘰𝘮𝘦𝘯𝘵𝘶𝘮. Because the reality is that total potential revenue opportunity for a startup is not a condition in itself: it’s the result won from passing through a series of barrier conditions (or Swiss Cheese slices) over the lifetime of the company. We believe that failure in VC underwriting is less attributable to “getting fooled” on the risk in one layer and more often due to overweighting one layer to the detriment of other important ones. If you are going to measure “how can this go right,” in other words, you need to look at the whole picture: all the slices and their interdependencies.

Markets matter, of course. But a single number, can never produce a valid binary judgement on market viability. Moreover, without factoring in key organizational conditions, TAM itself may be irrelevant. As we think about it at Euclid, a winner requires conviction that—if everything were to go right—it is possible that a linear path through the slices of risk exists. That’s a potential home run.

Finally, if we agree that the rare success case is the product of many layers of risk, it’s inherent that some of these layers will be high-filter. Put another way, some aspect of a startup is going to be a long putt, and that’s OK. As demonstrated in the above graphic, there are non-linear paths to progression and success. Just as Swiss Cheese has many holes, every barrier condition has multiple potential solutions. Such a non-linear path, however, may require time, patience, and the right team makeup to iterate to a venture-scale outcome. Such paths may pay off. Too many swerves, however, and founder patience, investor pockets, or the simple time-value of money may stifle you.

What You Have to Believe (WYHTB) in Vertical AI

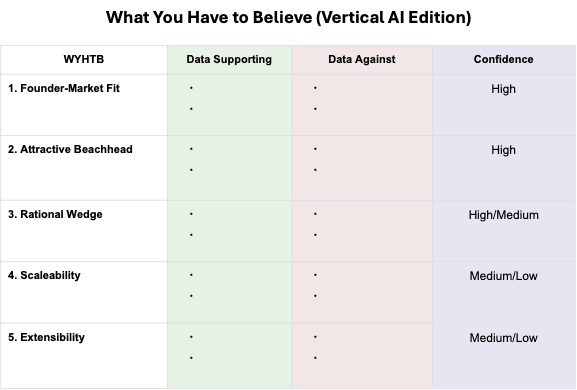

While the above model is a useful heuristic, it’s less useful as a framework for deal-by-deal evaluation. We can only say Swiss Cheese so many times before people stop taking us seriously (Emmental, anyone?). Our friends at Emergence Capital previously shared a more tactical implementation, inspired by their internal decision-making process: the “WYHTB” (What You Have to Believe) framework. We include their graphic below. In their own words: “it aims to identify the 3-5 specific things you have to believe will be true for this investment to return the fund.”6

The WYHTB framework is only as valuable as the things being evaluated; it’s essential not to fall into the same single-point-of-failure thinking we outlined above. “Large TAM” is not a worthwhile belief statement; it needs to be broken down into its constituent conditions for analyzing early-stage vertical markets. . Below is a generic outline of our framework for Vertical AI (including just the major categories of consideration, as for us, line items for different for each deal).

The first belief statement we evaluate is team-specific. Our founder analysis is not simply an analysis of aptitude, but founder-market fit: “a unique insight into a market (based on experience, not conjecture) + the ability to execute against it.” In vertical software, at least, the data bears out the fact that domain expertise correlates strongly with long-term success. Understanding the needs and preferences of potential industry stakeholders, connecting with them, and speaking their language are often prerequisites for effective customer discovery, sales, and product expansion.

The following two belief statements concern the beachhead market and the wedge product. At Euclid, we aim for high resolution of the beachhead and the initial set of customers a founder targets. This is where we spend most of our time evaluating an opportunity after analyzing founder-market fit. While this may sound like a TAM analysis, we are far more interested in assessing buyer urgency and adoption hurdles. Similarly, we also need to evaluate the attractiveness of that wedge as a control point to support a large business down the road. For founders, the goal of the vertical wedge product isn’t immediately capturing a billion-dollar TAM; it's earning the right to expand into one quickly.

In Vertical AI specifically, early winners suggest the AI-native authoring layer is the ideal wedge for many successful playbooks. Equally, workflows that generate more revenue or eradicate constraints to growth for customers are king. We typically target high confidence in our belief in the wedge product, but sometimes settle for medium resolution, depending on the team and stage.

The final two beliefs we evaluate center on the tactical requirements for scaling and being well-positioned for long-term success after reaching initial PMF. Scalability requires market pull in some capacity: customers want a solution that a startup can deliver. Beyond that, the degree of scalability will be evident in the number of prospective customers for the solution and the company’s ability to find leads, convert a certain percentage into customers, onboard new customers, and retain and grow those customers. Part of our work here is market-specific, while the other part is team- and product-specific.

Extensibility in this context refers to company and market-specific conditions required to produce a venture-scale outcome, specifically the vertical or horizontal expansion opportunities stemming from the “earned right” of initial adoption. The ability to expand to a large enough TAM is critical here, but it is also about defensibility and preserving long-term enterprise value. In Vertical AI, we highlighted the common “extensibility” framework that has led to early successes in many startups. It’s important to note that this does not preclude horizontal expansion opportunities well.

In summary, this is our WYHTB framework for Vertical AI startups:

Founder-Market Fit: Unique insight into a market & the ability to execute.

Attractive Beachhead: Identified a constraint to stakeholder revenue (or in some cases another mission-critical business input) that AI can unlock.

Rational Wedge: Easy-to-adopt wedge product with the following characteristics (a and b being the most important):

Powering an essential workflow that ties to revenue growth.

Serving as the authoring layer for this workflow.

Becoming the highest engagement application.

Scaleability: Ability to drive meaningful adoption of the wedge + integrate with existing systems of record as needed to maximize data ingestion & stickiness.

Extensibility: Leverage the starting point, or authoring layer, as the base unit for a new system of record…the System of Intelligence.7

Thanks for reading Euclid Insights! If you know a founder thinking through Vertical AI playbooks or fundraising, we’d love to be a sounding board. Just reach out via LinkedIn, email, or here on Substack.

Andreesen (2007). Product / Market Fit. Business Management for Electrical Engineers and Computer Scientists, Stanford University.

McKay (2022). The Swiss cheese infographic that went viral

Michael Lewis wrote a great book on their relationship and work together:

Lewis (2016). The Undoing Project: A Friendship That Changed Our Minds. WW Norton.

Kahneman, Tversky (1973). Availability: A heuristic for judging frequency and probability. Cognitive Psychology.

Gilovich, Griffin, Kahneman (2002). Heuristics and Biases: The Psychology of Intuitive Judgment. Cambridge University Press.

Extensibility conditions can also refer to selling existing products into adjacent markets, but we’ve excluded for simplicity.