Emerging Playbooks in Vertical AI

From Authoring Layer to Systems of Intelligence

Last fall, we wrote an essay—“Nobody Wants Your Product!”—on the journey to product-market fit as an early-stage vertical software founder:

The premise always sounds logical in principle: this product will increase revenue and / or decrease costs. It’s cheaper and has a modern UI. The ROI is obvious. Why wouldn’t they buy it? The complicated answer is that nobody wants your product! Customers don’t care what you think they want or how you think their company should operate. Customers don’t wake up each day thinking about what new piece of software they should buy.

While reaching product-market fit in any B2B market is challenging, vertical industries can be exceptionally cruel: buyers may be unsophisticated about technology, budgets may be non-existent and difficult to ascertain, and adoption hurdles can be steep and unintuitive. Five months later, we wanted to revisit this piece (the software world moves fast!) to zero in on what we’ve learned about building AI products for vertical industries.

Last year, we posited that AI-first vertical software would be the near-term winners of LLMs' increasing performance and decreasing costs. Ten months later, we believe this statement is holding firm:

We believe most promising B2B application-layer opportunities for LLMs will be vertical, where: (1) harder-to-aggregate or proprietary data is required for model training, (2) the addition of domain-specific symbolic models/experts are necessary for accuracy, and/or (3) layers of workflow software are necessary to deliver real-world impact.

Since then, we’ve seen incredibly rapid revenue growth from early breakouts like Abridge, EvenUp, Fieldguide, and others. At the same time, we have witnessed significant disruption and business model uncertainly thanks to the continuing commoditization of LLMs themselves. Open-source models such as Llama from Meta, R1 from DeepSeek, and others achieved near-parity performance at a fraction of the cost of ChatGPT et al.—distilled models may have a leg up in training, but inference costs are decreasing by an order of magnitude annually.1

For AI-first application-layer startups, it’s great news. As with early cloud storage and processing, increased AI infrastructure accessibility is driving a Cambrian explosion of LLM-powered applications, especially vertical ones. As an idea-stage founder, the upfront investment to build design-partner-ready MVPs is a fraction of what it was ten, even five years ago. That said, more room to experiment also means more strategies to vet. Thanks to LLMs, after all, a whole new universe of wedges just dropped.

How to Find Your Winning AI Wedge

So, you’re building an AI-first vertical platform—where should you start? Interestingly, we find that the novel capabilities of LLMs have expanded the potential entry-point problems a startup can solve. As we discussed in our essay “The Next Chapter of Vertical Software,” we continue to see the early success of startups applying AI to ubiquitous, mandatory “work to be done” within a target market:

The ability to synthesize unstructured voice and text data and extract information (for example) has rapidly opened up new opportunities for AI-first startups to attack novel revenue-generating opportunities and markets. Combining these capabilities with mission-critical workflows, new entrants can rapidly gain adoption even in markets with constrained IT budgets and / or entrenched incumbents.

In revisiting our analysis, it’s critical we consider what LLMs can enable that a previous-generation SaaS company couldn’t. In our view, the answer here comes down to friction. Both SaaS-first and AI-first vertical products target high-value workflows. SaaS, however, inherently requires the adoption of a new UI, including training and perhaps even market education. Vertical AI wedge products, however, can leverage natural-language interfaces to reduce or even eliminate the adoption curve. What is easier to adopt than a solution that mirrors your existing workflow, but instead makes the calls or intakes the customer info on your behalf?

In addition to frictionlessness, the other key to an ideal wedge is urgency. And for most businesses, nothing is more urgent than cash money. Which is why we continue to believe—in AI as in SaaS—that workflows generating more revenue or eradicating constraints to growth are king. Especially when time-to-proof can be near-immediate. Roofr, for example, provided tools for roofing companies to respond to leads within minutes versus multiple days, improving their win rates and helping customers grow their business. LLMs shine particularly brightly when they can break down chokepoints in the revenue-generation cycle previously occupied by humans.

Next, we ask: what is this wedge winning us the right to build? As powerful as LLMs are, we’ve established that the foundational technology itself has few moats. We see AI wedges as—ideally—the launch point for a particular high-value workflow. A motion that doesn’t just automate something; it results in an output that will be used and increasingly relied upon by the business. We call this species of wedge solution the “Authoring Layer.” Because it is the first step in a process, it often does not require substantial integrations with pre-existing SaaS. It creates something that a human would’ve created—documentation, notes, a lead, an appointment—and hands it off to another system as a human would have. Already, you have a sense for what you might build next... just follow the workflow.

For example, EvenUp's wedge product, an AI-powered demand-letter generation tool, served as an ideal starting point for the business to layer on additional products and services, from intake to case resolution, ultimately striving to capture the workflows of the PI vertical at large.

As AI wedges grow into AI-powered platforms, they have an additional advantage over traditional SaaS. All software aims to foster user engagement: becoming the tool that your customer spends the most time in, day-to-day. AI-predicated platforms, however, can much more readily turn that data into additional value. Abridge is an excellent example of such a product, as it is an always-on tool for clinicians that automates documentation and auto-populates the EHR. As outlined in their product white paper, the business is leveraging its foundation of voice capture to build defensible uses cases across the clinician workflow:

Evaluation is not just a set of guardrails, but a compass. Continuous evaluation of our product is not just designed to catch or prevent issues, but to drive improvements of our product at scale.2

To summarize, we look for three critical ingredients in a successful AI-native vertical wedge product:

Serving as the authoring layer (i.e., launch point) for a valuable internal workflow.

Powering an essential workflow that unlocks revenue, perhaps agnostic to peripheral systems to start, but absorbing downstream progressively.

Becoming the highest engagement application, leveraging usage to build moat.

Are all three attributes an absolute requirement for the success of your wedge? Absolutely not—it wouldn’t be a rule, if there weren’t exceptions. The engagement criterion in particular, often will not be present until more of the workflow is absorbed. Some AI wedges, in fact, are predicated on not requiring engagement, to streamline intial adoption. Startups that are capturing and deriving value from novel first-party customer data—or focused on increasing its utility—are less likely to begin in the Authoring Layer. By and large, however, we believe most successful AI-native vertical software startups will have a credible path to all three of these ingredients.

Your Vertical Customer Doesn’t Care About AI

Ingredients to a successful product, of course, are irrelevant if it doesn’t solve a top pain point for your user. At Euclid, this is one reason we seek founders with a hyper-focus on both the customer mindset and workflow. Namely, understanding what they are trying to achieve and why, rather than building a generic “Co-Pilot for X or Y.” In other words, we want to avoid opportunities where the AI idea feels like a “hammer in search of a nail.” Ideally, founders should look for nails that (1) AI can hit well and (2) prior hammers could not.

The team at Irrationational Labs, a behavioral design consulting firm, did some great analysis on the buying behavior of customers faced with AI-product choices.3 Their takeaway, which we think is strongly confirmatory to our anecdotal experience, is that AI labeling is no guarantee of success. A few interesting headlines: labeling a product “Generative AI” lowered performance expectations, willingness to pay, and confidence in the reliability of the output. To summarize their takeaway:

[Customers] don’t automatically associate “AI” with “better.” In fact, some skeptics might assume the opposite. While AI might power the underlying technology, it shouldn’t be the headline—a notion that might seem counterintuitive if you’re in Silicon Valley and used to drinking the Kool-Aid of innovation. The real value lies in how your tools improve lives, make work more efficient, and help users achieve their goals.

They do note that this data is focused on end-users who are “average people” and not early adopters, but this is likely true in many vertical markets. To test these assumptions, let’s look at the landing pages for the three example companies we referenced above: EvenUp, Roofr, and Abridge.

Interestingly, EvenUp only has a small reference to AI on its website, while Roofr does not mention it at all. Abridge does lead with AI for their product. Perhaps there is an argument for leading with AI framing if targeting sophisticated buyers who are looking for a specific product in an emerging (but already existing) category. Abridge was not the first nor the last AI clinical scribe, so it’s undoubtedly true that enterprise buyers in that segment are more well-informed. Regardless, all three focus on the tangible discrete benefits to the buyer from utilizing the product versus the “Co-Pilot for X” taglines that we suggest founders avoid. Similarly, all three focus on their products’ hard ROI and ability to drive revenue (or remove bottlenecks to revenue).

How to Win Beyond the Wedge

Our friends at Tidemark have done great work on the patterns of control points in Vertical Software. Most vertical software markets have one or two control points that serve as ideal patterns for building strategically dominant Vertical Software companies. Earlier, we touched on what we believe to be the optimal control point for most AI-native products: attacking a mission-critical workflow that can unlock revenue and immediate ROI.

Coincidentally, some of the same attributes that make “workflow” focused control points ideal initial vectors for a vertical software startup also mean they may have low long-term defensibility. Again, the benefit of the wedge in this case is that it’s high value, easy to adopt, and can serve as a standalone piece of software by serving as the starting point of a process. Definitionally, the switching costs are not high. As such, startups must leverage their beachhead product into additional software and services that build long-term staying power. As we wrote in our initial vertical AI piece, “The Future of AI is Vertical,” data ownership will play a central role:

While our underwriting framework to pick winners must evolve with the times, its fundamental tenets remain unchanged. Recent developments have reinforced certain pillars of our process: the ability to build a “Vertical Data Moat”—a long-time heuristic of ours—is more critical now than ever

While we stand by this broad statement a year later, it is worthwhile to expand on it with a deeper, first-hand look at some of the models we believe will deliver entrenched long-term value. Traditionally, a data moat refers to the compounding advantage of a startup as it aggregates data that enables a superior product and UX. We don’t believe this will change in the current era of AI. Startups that can collect a growing corpus of high-quality data will have a compounding advantage in training domain-specific LLMs, as many have discussed. Beyond fine-tuning in language-based specialization, however, it remains unclear how many other domains even have enough available training material to train an LLM as successfully as we have with natural language.

Vertical Systems of Intelligence

Another, more transformation competitive advantage lies in creating new “intelligent” systems of record leveraging first-party data an AI-first vertical product captures. The Authoring Layer serves as a foundational element for this vision.

To draw out the path to a System of Intelligence, let’s use the three aforementioned vertical AI companies as examples:

EvenUp is building a system of record around claims and the demand letter as the entry point for a CRM-like product for personal injury law (that integrates or sits outside of the PMS).

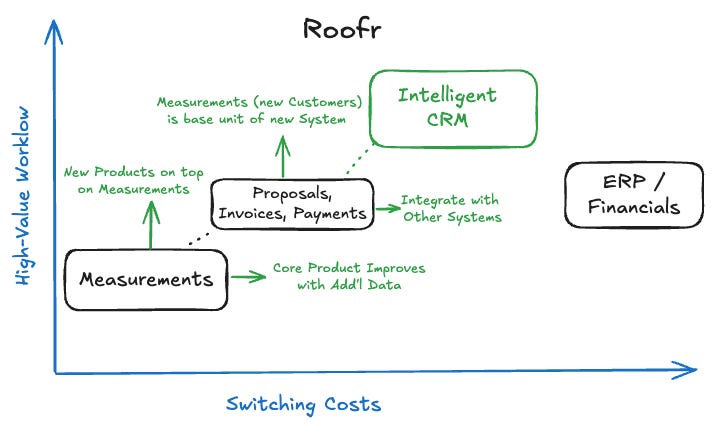

Roofr started with measurements as their ‘authoring’ tool, meaning every home address can serve as a record for their CRM and ERP-adjacent tools. A measurement turns into a lead; a lead turns into a customer; a customer turns into a job, and a job requires materials, workers, financing, etc.

While there is less publicly available around Abridge’s roadmap, we have certainly seen other AI-native scribes aiming to build everything-but-the-EHR systems of records (and some brave founders who may even try to replace the EHR eventually). For this exercise, we’ll stick to mapping out what Abridge has published publicly.

The Authoring Layer is foundational to the System of Intelligence because it begins by taking over the data entry step. In doing this, we understand what a proper data object looks like. The platform can proceed, however, to understand what data entries are desired, why, and when a business owner needs to know about then. While we believe natural language is unlikely to replace software UI wholesale, it absolutely shines in data discovery. You can see how the entire System of Record concept can be re-imaged.

We see massive eventual opportunity in this concept. Business process mining or mapping is increasingly popular in complex enterprise environments. Pioneered by the likes of Celonis, executives can leverage complex analyses of inputs, processes, human capital, and outputs at scale to drive results. Today, entire custom CRMs and ERPs—with ultimate price tags in the 8+ figures—are build around learnings from such analyses to min-max business processes. But doesn't it seem suboptimal to build a prescriptive, UI-heavy workflow system first, and then hope it matches your process for enough years to recoup the investment? What better than a System of Intelligence to model and maximize a business’ priorities holistically, and improve it over time? We see a future where AI-powered software evolves in vivo from process, rather than the other way around.

The Winning Playbook

Of course, no such grand visions are possible without first achieving product-market fit and winning your beachhead ICP. Which is why at Euclid, we like to think big but start simple. To reiterate the AI-native vertical playbook:

Identify an impactful constraint to revenue that AI can meaningfully address

Build an easy-to-adopt wedge with these characteristics (especially a and b):

Powering an essential workflow that unlocks revenue growth.

Serving as the authoring layer for a valuable internal workflow.

Becoming the highest engagement application.

Drive adoption of the wedge and integrate with existing systems of record as needed to maximize data ingestion & stickiness.

Leveraging the starting point, or authoring layer, as the base unit for a new system of record… the System of Intelligence.

For most startups, much of the above path likely begins in earnest only after Series A. Regardless, we recommend that founders begin crafting the narrative well ahead of that milestone, identifying the first expansion product(s) and demonstrating the capture of a control point. As we wrote in last week’s piece on Vertical Market Sizing, an early-stage team should stay focused and insulated… but a CEO should always be able to define the long-term strategic vision and have a clear answer to that perennial, predictable, but important VC question: how are you getting to $100M of ARR?

Thanks for reading Euclid Insights! If you know an AI-native vertical founder thinking through their next idea, market, or wedge product, we’d love to be a sounding board—feel free to reach out via LinkedIn, email, or on Substack.

https://a16z.com/llmflation-llm-inference-cost/

https://www.abridge.com/ai/science-ai-evaluation#

I’d like add to this conversation:

Most companies with proprietary data have focused on building the UI as an enabler for humans to improve their workflow. In the era of Agentic AI, there is a huge opportunity in charging for access to data via an API, skipping the UI layer completely. Agents don’t need UIs, they need access to databases at scale.

Having said that, I do see a future where new roles emerge related to AI such as quality control and compliance or approval layers and a UI is absolutely critical for that workflow.