I) Titan - Nate Baker, Co-founder & CEO at Qualia (and Fractal)

II) Playbook - Vertical Product Expansion

III) Market Pulse - Vertical Voice AI, Agentic SaaS Disruption & MoreSome of the biggest opportunities in the startup and venture world occur when norms are changing too fast for most to update their priors. As we’ll hear from Nate Baker today, Vertical AI today is driving just one of those moments, as viable market sizing changes under our noses at an accelerating pace.

In an AI-driven vertical software world, traditional TAM math is a form of intellectual debt. It anchors you to yesterday’s workflows, yesterday’s labor costs, and yesterday’s definition of what software is “allowed” to do. As this week’s guest puts it, early-stage TAM sizing assumes a fixed market—when in reality, the best vertical companies expand the market by replacing services, collapsing labor, and continuously taking on more of the customer’s actual work.

That reframing matters more now than ever. LLMs are accelerating how quickly new wedges can reach revenue—but they’re also compressing timelines, commoditizing surface-level features, and exposing which products actually own the structured workflows underneath. In that environment, obsessing over TAM too early can blind founders to the real question: can this product keep expanding what it does for the customer as capability improves?

Of course, this doesn’t mean that TAM is completely dead and buried. It just means that traditional conceptions of TAM are—sticking to them can leave both investors and founders dead in the water. The reality is that VCs still need some heuristic to make sure an opportunity is big enough to support the venture scale needs of their fund math. Some of the biggest opportunities, however, are starting in beachhead markets that would have been traditional non-starters.

This episode is a deep walk through that tension with Nate Baker, who’s lived both sides: building Qualia into a core system of record for title agents—and then building Fractal Software into a factory for launching vertical SaaS companies at scale.

We talk about why Nate no longer believes in TAM at pre-seed and seed, why speed-to-revenue wedges are winning for now, and why clean, system-of-record-grade workflows remain the most durable foundation for AI automation. It’s an important conversation about the assumptions you may need to unlearn.

Don’t forget to subscribe to get weekly episodes like this in your inbox—available on YouTube, Spotify, and more—and check out our sponsor below to support the show. Happy listening!

This episode is supported by Parafin, the leader in embedded finance for vertical platforms—helping software companies launch custom financing programs directly inside their workflows.

Here’s how Parafin can help.

I) Vertical Titan

Nate Baker — Founder @ Qualia

The backstory

Nate started Qualia ~11 years ago to build software for one of the most under-appreciated roles in real estate: the title agent. The bet was straightforward and brutal: become the core system of record in a market with “unbelievable” regional complexity, then compound vertical platform value from that foundation.

Since its founding in 2015 by Nate and his co-founders Lucas Hansen and Joel Gottsegen, Qualia has streamlined an industry historically burdened by paper, manual coordination, and siloed systems. Critically, they had found a true “lightning bolt workflow,” as our prior guest Scott Wolfe Jr. of Levelset would put it: rather than building for just one stakeholder, Qualia brings together buyers, sellers, lenders, title & escrow professionals, and agents. Today, the platform processes transactions used by >1M real estate professionals and touches millions of homebuyers every year.

To date, Qualia has raised well over $200M from top investors like Tiger Global, Menlo, and 8VC, reaching unicorn status along the way. It’s expanded both organically and through acquisitions—most recently integrating Old Republic Title’s RamQuest and E-Closing platforms in a strategic roll-up designed to deepen its title production stack. That combination of capital, talent, and M&A has supported headcount growth into the 600+ FTE range, with core teams across SF and Austin.

What makes Qualia an especially interesting case study for Verticals is that it’s both a vertical SaaS and a vertical AI story. Nate is evolving the product rapidly into AI-enabled automation and structured process intelligence, infusing the real estate closing ecosystem with machine-powered document processing, data extraction, and collaboration tools. In other words, Qualia is a disruptor—but in another way, an emerging incumbent that’s using it’s market leverage to become a system of action. It’s an interesting lesson in how—while most incumbents simply don’t have the incentives and resources to do so—some companies of scale with “startup-minded” management can keep moving fast in the world of Vertical AI.

Having fallen in love with the model, however, just one or two vertical startups wasn’t enough for Nate. Six years ago, he also co-founded Fractal Software, a venture studio designed to launch vertical SaaS. Since then, Fractal has helped start ~150 vertical SaaS companies—initially skewed toward full systems of record, and now increasingly experimenting with faster AI-driven point solutions. Over the course of Fractal’s first first years, Nate has learned a ton about the inputs to vertical SaaS and AI success—and was kind enough to share those learnings with us today.

The hardest part

Earning “system of record” trust when every state (and every customer) insists their workflow is uniquely complicated

Staying disciplined on the core product while continuously expanding ACV, without distracting R&D into a mess of side quests

Competing against legacy incumbents that are still on-prem—and can’t ship fast enough to keep up with AI-driven expectations

Reconciling two truths at once: incumbents should win with distribution, but many won’t move quickly enough

Staying ahead of the curve in AI: navigating a world where “six months from now, what’s in market today will be legacy”

Memorable lines from Nate

“I fundamentally don’t believe in TAM sizing anymore at pre-seed, seed… the ability to grow the end market is limited only by your creativity and ability to build value for your customer.”

“If you’re starting today, you have to prioritize speed to revenue.”

“The primary constraint on rolling out LLMs is actually clean, structured workflows.”

“Every business that is not seriously reevaluating their product offerings right now is going to be done in 24 months.”

Why “TAM” is the wrong question in vertical SaaS

Nate’s push isn’t that market size doesn’t matter—it’s that early-stage TAM math is usually anchored to old spending patterns (“reasonable ACV x number of customers”) and ignores what great vertical products actually do: they expand into adjacent workflows, replace services, and increasingly replace labor.

In other words: the real question isn’t “Is the initial wedge TAM big enough?” It’s “Can you durably keep expanding what you do for the customer as capability increases?”

Layer-cake strategy, and the common mistake it invites

The classic vertical playbook—core system of record first, then add modules—still works. But Nate flags a trap: teams can over-rotate into “multi-product” too early and lose the focus required to make the core product fly off the shelf with strong sales efficiency.

His heuristic: if the core product has strong sales efficiency and growth is compounding, don’t rush the adjacency just to chase incremental ACV. Expand, yes—but don’t distract yourself out of momentum.

Point solutions vs. system of record in the LLM era

This was the central debate: do you still bite off the hard ERP first, or do you start with a wedge and integrate backward?

Nate’s take is nuanced:

If you already are the system of record, you’re advantaged—especially because LLM rollout depends on structured, interpretable workflows.

If you’re starting today, the pace of change pushes you toward speed-to-revenue wedges first, then building back toward the system of record over time.

The “structured workflow” moat

One of the most tactical insights: LLMs don’t magically fix messy businesses. They need clean workflows and data you can trust. That’s why many point solutions struggle to move from “cool demo” to “deep automation”—they can’t access or shape the underlying system-of-record-grade workflow.

For founders, this reframes “data moat” into something more operational: can your product impose structure, not just read unstructured data? We’ll paraphrase a relevant quote from Niket Desai, co-founder of Laurel, around gauging whether your data / AI strategy is actually contributing to a moat: “are you adding net-new columns of data?” Or just derivative of existing systems of record?

The incumbent clock is shorter than they think

Nate described a common legacy mindset: “We’ll ship something similar in 12–18 months.” In the AI cycle, that pacing is fatal—because the product standard moves every quarter, not every year.

This is also where the on-prem vs. cloud gap becomes existential. If you missed the cloud transition, AI-native delivery becomes dramatically harder to execute and iterate.

Inside Fractal Software: how to launch 150 companies

Fractal started from a simple observation Nate and his co-founder Mike Furlong shared: in many verticals, company-building is less like inventing a new science project and more like constructing a commercial building—repeatable if you systematize research, recruiting, and early capital.

The reported outcome: Fractal could compress the timeline from “I want to start a company” to “founder in seat with an MVP and real customer motion” by ~a year.

Fractal’s highest-signal founder lessons

With a big enough sample size, patterns emerge. Nate highlighted a few:

If co-founders are in the same city but don’t work together ~5 days a week, it’s a red flag for Nate. Remote teams, however don’t underperform co-located founders.

Founder ability to sell matters hugely—especially when paired with care for engineering craft. This doesn’t mean they have to be without a stereotypical salesperson, or even be primarily commercial. They just need to be able to drive founder-led sales effectively themselves.

Speed to MVP and speed to first revenue are leading indicators. Even 2 months in, lagging commercial movement is often predictive.

II) Vertical Playbook

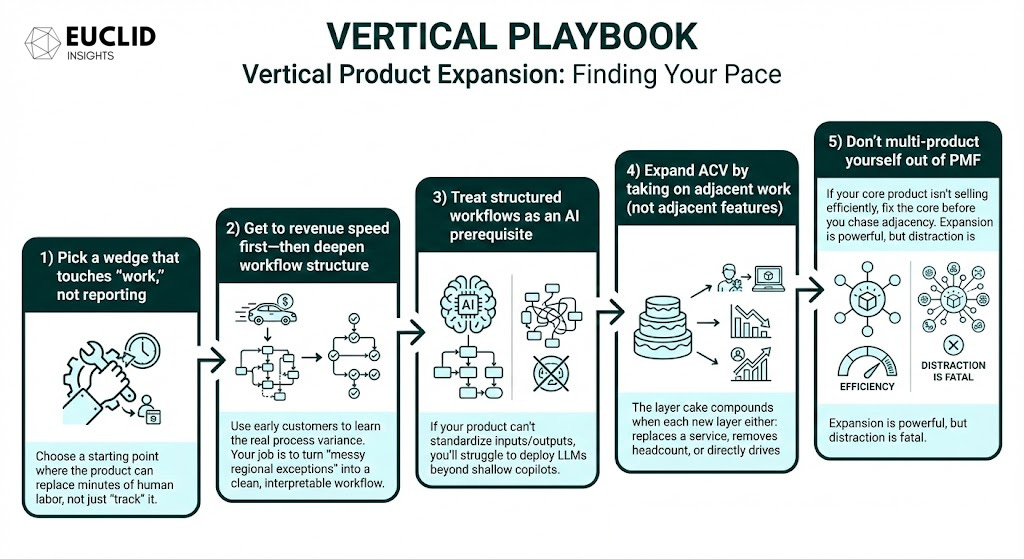

Vertical product expansion: finding your pace

Inspired by Nate Baker, Co-Founder & CEO of Qualia

Why it works

In a fast-moving AI environment, time is a competitive weapon. A wedge product can get real distribution and real revenue while the tech frontier is still shifting. But the wedge only becomes durable when it connects to (or evolves into) the structured workflow layer that agents can automate reliably. As mentioned above, moving into a “layer cake” strategy too early can be a trap. Founders need a framework to gauge when then should double-down on the core vs. when it’s time to layer on new offerings to expand TAM and share-of-wallet.

How to run it

1) Pick a wedge that touches “work,” not reporting

Choose a starting point where the product can replace minutes of human labor, not just “track” it.

2) Get to revenue speed first—then deepen workflow structure

Use early customers to learn the real process variance. Your job is to turn “messy regional exceptions” into a clean, interpretable workflow.

3) Treat structured workflows as an AI prerequisite

If your product can’t standardize inputs/outputs, you’ll struggle to deploy LLMs beyond shallow copilots.

4) Expand ACV by taking on adjacent work (not adjacent features)

The layer cake compounds when each new layer either:

replaces a service,

removes headcount,

or directly drives customer growth.

5) Don’t multi-product yourself out of PMF

If your core product isn’t selling efficiently, fix the core before you chase adjacency. Expansion is powerful, but distraction is fatal.

Founder litmus tests

Does the wedge get you to meaningful revenue quickly without locking you out of the system-of-record path later?

Can you uniquely access and structure the workflow data needed for agentic automation?

Are incumbents technically capable of shipping at today’s pace—or are they stuck in “12–18 months” land?

If the wedge becomes commoditized in six months, do you still have a compounding roadmap?

What we debated on-air

The open question: will the best vertical companies of the next era still start by rebuilding the system of record—or will they mostly start with fast wedges, then integrate backward as LLM capability expands?

Nate’s answer leaned pragmatic: if you’re starting today, prioritize speed to revenue. But if you can become (or already are) the system of record, it’s still the most advantaged position for durable AI automation.

III) Vertical Market Pulse

Are vertical voice agents the easiest “instant AI ROI”?

Toma’s AI voice agents have taken off at car dealerships | Sean O’Kane @ TechCrunch

AI voice feels like the new “hello world” of vertical automation: it’s magical in the demo, easy to adopt, and doesn’t require a full rip-and-replace of the core system. That’s exactly why it’s spreading fast across industries where phone calls are revenue (auto dealerships, field services, healthcare intake, etc.).

The founder implication: wedges that attach to obvious pain (calls, scribing, outbound scheduling) can get to real revenue quickly—but you still need a plan for where you’ll compound once the novelty becomes table stakes.

Is Agentic AI disrupting SaaS?

Will Agentic AI Disrupt SaaS? | Crawford, McLaughlin, Doddapaneni, Fiore @ Bain & Company

As agents get better at “doing work,” control points are shifting: who owns the source-of-truth data, who orchestrates the tools, and who owns the interface where outcomes get requested and verified.

The founder implication: “agent wrappers” without deep workflow integration can scale quickly, but the durable winners will either (a) own the system-of-record-grade data structures, or (b) become the orchestration layer that everyone else plugs into.

Embedded fintech is still expanding the “layer cake”

How Xplor & Parafin bring embedded financing to local SMBs | Team @ Parafin

We’re still watching vertical platforms turn “software spend” into “operating leverage”—and embedded financial products are a major accelerant. When capital is native inside the workflow, it’s not a feature; it’s a revenue line and a retention engine. Much more on this from our past episode on Vertical FinTech with Rahul Hampole, head of fintech ServiceTitan.

The founder implication: the best expansion paths are the ones that turn your product into a business partner (not a dashboard). If your platform can directly help customers grow revenue, manage risk, or fund expansion, your ACV ceiling changes.

Next week on Verticals

Tune in next week as we unpack Enterprise Vertical AI with Michael Saltzman. He’ll share his journey building EvolutionIQ through a $750M acquisition.