Few sectors are as complex or fragmented as commercial construction. It’s a massive, multi-trillion-dollar ecosystem where every project has several integral decision-makers and points of value. For a Vertical AI founder bringing value to that entire universe, the question of “who do you charge, and how?” is notoriously difficult to answer.

On this episode of Verticals, we sat down with Mike Powers, Co-founder and CEO of BuildVision, to discuss how he is answering that question by rewriting the playbook for multi-stakeholder industries.

Below, we’ll dig into Mike’s strategy for Multiplayer Vertical AI success. But first, some background on the founder and business making it happen. Naturally, we’re a bit biased at Euclid, as BuildVision’s first investors — we’ve written a bit more on the deal here. But we think you’ll find the story as compelling and insightful as we did.

PS: Going forward, we’ll just be posting the intros to our Verticals episodes here on Euclid Insights — full episodes will live at YouTube (and Spotify / Amazon).

It would mean a ton if you could please take a quick second to subscribe.

We appreciate your support!

Huge thanks to Parafin for sponsoring this episode, and for helping make Verticals happen. Embedded finance is one of the biggest untold stories in Vertical AI, and it’s growing faster than ever. Whether you’re a founder or an investor, Parafin’s story is worth checking out.

Click here to learn more!

I. Vertical Titan

Mike Powers, Co-Founder & CEO of BuildVision

Mike has lived the problem of construction procurement, from multiple stakeholder vantage points, for over a decade. His career began at Turner Construction, one of the country’s largest general contractors, working in their strategic procurement arm. There, he saw firsthand how leveraging buying power for strategic equipment—critical infrastructure like chillers and switchgear—could turn a cost center into a profit center.

Mike eventually transitioned to the tech side, joining bid-management platform BuildingConnected, initially as an SDR. There, he had a quick ascent, and ultimately found himself running enterprise sales for a hyper-growth Series A business. Shortly after, BuildingConnected was acquired by Autodesk for a bit under $300M. He would stay on at the construction software giant for a while — and while overseeing a $200M sales organization there kept him busy, the idea for a dedicated procurement platform never left him.

In 2023, just three days after his son was born, Mike left Autodesk and officially launched BuildVision. The platform serves as a modern procurement solution for general contractors (GCs) and OEMs, streamlining the sourcing, purchasing, and tracking of complex, engineered equipment. But BuildVision isn’t just a digital clipboard or “procurement CRM.” It’s a true “multiplayer” platform designed to serve both GCs and OEMs.

The “Multiplayer” Architecture: The Event Ledger

Most vertical software starts as “single-player” tools—improving the workflow for just one stakeholder (e.g., a project manager at a GC). BuildVision, however, was built from day one to be the connective tissue between the General Contractor (Buyer) and the OEM/Rep (Seller).

The “Event Ledger” Concept

Mike describes BuildVision’s ultimate goal as becoming the “event ledger for equipment.” Instead of just tracking a purchase order, the platform records every state change of a critical asset: how it is engineered, specified, sourced, financed, transacted, and delivered to the job site.Free Utility to Build the Network

To make this “multiplayer” ecosystem work, you need density on both sides. BuildVision aggressively removes friction by making the core workflow tools free.For Buyers (GCs): Tools to ingest 3,000+ pages of construction documents, structure data, and send RFQs are free.

For Sellers (OEMs/Reps): Tools to ingest emails, process documents, and drag-and-drop proposals are also free.

The Strategy: By commoditizing the “table stakes” SaaS features, they capture the data flow across the entire network, creating a proprietary data moat that is hard for point solutions to replicate.

Monetization: Aligning with Outcomes, Not Seats

Instead of charging a flat subscription fee (like the $7-10k ACV Mike saw at BuildingConnected), BuildVision monetizes where value is actually created or risk is reduced. Mike calls this “capture” — taking a percentage of the value flowing through the platform.

Here are the three specific ways they monetize outcomes:

1. Procurement

BuildVision acts less like a software tool and more like an automated procurement agent. When a General Contractor needs to make a complex decision—like selecting an alternate chiller manufacturer to save money or time—BuildVision helps execute that buy.

The Model: They take a transaction fee (ranging around 3%) on the equipment purchase.

The Value: The GC is happy to pay this because BuildVision is often de-risking the purchase, ensuring engineering specs are met, or improving lead times—outcomes that directly impact the project’s profitability.

2. Finance

Construction is plagued by slow payment cycles (Net 90 or Net 120), which squeezes OEMs. BuildVision leverages its position as the “ledger” to solve this cash flow problem.

The Model: BuildVision connects capital providers directly to the OEM to pay them on Net 1 terms (immediately) instead of months later.

The Value: In exchange for immediate payment, the OEM accepts a discount. BuildVision captures that spread, effectively “selling dollars” to manufacturers who are desperate for liquidity—but doing so in a way that benefits all parties.

3. Support Sellers

Because BuildVision normalizes unstructured data from emails and PDFs, they can offer their customers insights they’ve never had before.

The Model: They monetize by providing OEMs with forecasting data and “win/loss” analysis.

The Value: Manufacturers can see why they are losing bids (e.g., over-specifying equipment) or get accurate forecasts of upcoming project demand, allowing them to adjust pricing or production dynamically.

Giving the SaaS Away

Mike Powers is betting that in the age of AI, the value of the “interface” will go to zero. By giving the “SaaS” away, BuildVision captures the transaction and the data, allowing them to monetize the outcome (buying better, getting paid faster) rather than the tool. This “decision layer” is the company’s core asset and moat, valuable to all stakeholders across the ecosystem.

II. Vertical Playbook

Building for Multiplayer Ecosystems

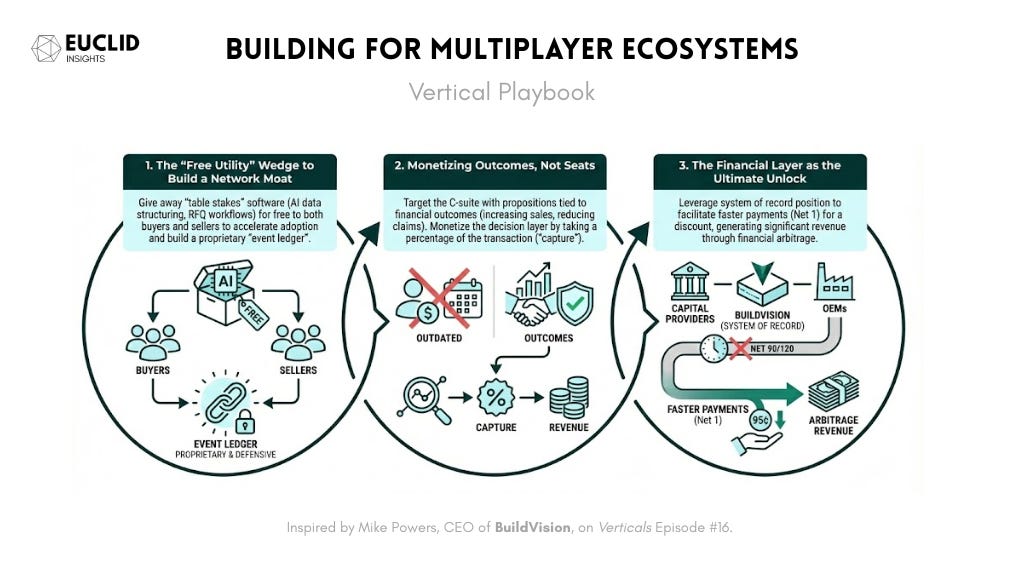

The most compelling part of Mike’s strategy is how BuildVision navigates the “stakeholder maze” of Vertical AI in a complex industry ecosystem. Here is a breakdown of how they are executing a next-generation vertical strategy — with a focus on how to balance monetization and adoption.

1. The “Free Utility” Wedge to Build a Network Moat

In the age of AI, where “vibe coding” a point solution is becoming easier, defensibility requires a network moat. BuildVision takes a contrarian approach: they give away the “table stakes” software for free.

Whether it is an AI tool that scrapes 3,000 pages of construction documents to structure data or a workflow for sending RFQs, BuildVision offers these utilities at zero cost to both buyers and sellers. As Mike puts it, “What we consider table stakes tools are free and will always be free... How do we create a best-in-class tool... giving that away on both sides of that procurement network marketplace?”.

This strategy accelerates adoption and data aggregation, allowing them to build a proprietary “event ledger” for equipment that tracks how assets are designed, procured, and delivered.

2. Monetizing Outcomes, Not Seats

If the software is free, how does BuildVision make money? By replacing work and underwriting risk.

Mike contrasts this with his days at BuildingConnected, where success was defined by $7,500 subscriptions and high-velocity sales calls. At BuildVision, they target the enterprise C-suite with a proposition tied directly to financial outcomes—increasing sales or reducing claims.

“If we don’t do any of that, we don’t make any money. But if we do that, we benefit from the upside,” Mike explains. By leveraging their data to help GCs make better alternate decisions on equipment, BuildVision takes a percentage of the transaction (what they call “capture”), effectively monetizing the decision layer rather than the interface.

3. The Financial Layer as the Ultimate Unlock

Perhaps the most potent insight for founders is how BuildVision plans to leverage its position as a system of record to solve cash flow problems. In construction, payment terms are often painfully slow (Net 90 or 120).

Because BuildVision connects capital providers directly to OEMs, they can facilitate faster payments—offering Net 1 payment terms in exchange for a discount on the purchase order. “We can go sell them dollars for 95 cents,” Mike notes, pointing out that this financial arbitrage can generate significant revenue without needing to act as a traditional reseller.

The Takeaway for Vertical Founders

The lesson from BuildVision is clear: in complex, multi-stakeholder verticals, the future isn’t just about charging a SaaS fee for a better interface. It is about giving away the workflow to capture the network, and then monetizing the transaction, the risk, and the capital flow. As foundational AI models continue to improve, the “wrapper” value erodes, but the value of a proprietary data moat and verified outcomes — the “decision layer” — only increases.

Catch the full episode with Mike wherever you watch / listen. See you next week!