Most vertical founders building a system of record (or action) eventually faces the same problem: your product is better, your demo is clean, the prospect is nodding along… “But we’ve been on this system for twelve years.” Rip-and-replace friction left a big graveyard of vertical SaaS startups. While Vertical AI offers fresh approaches to dealing with it, the psychological barrier buyers have around “having done things the same way for 10+ years” is equally present.

In the $80B US liquor retail market—90% independently owned, averaging $2.5M annual revenue per store (roughly 3x a typical restaurant)—that objection is universal. Darren Fike, Founder & CEO of Santé, is taking a meta approach to the issue by incorporating agentic AI into his product purely dedicated to mitigating the costs of switching off status quo platforms. This episode is a great reminder that AI isn’t just a product strategy—it’s a GTM weapon that can work especially well to overcome vertical market adoption challenges that SaaS alone never could.

Support Verticals by subscribing on YouTube, if you haven’t had a chance. Keep reading below for our episode roundup and Vertical Playbook: AI-Powered Rip-and-Replace!

The Santé Story: From Stockroom to C-Suite

Darren’s path to founding Santé didn’t start in a conference room. It started on the floor of a liquor store in Tribeca. While working full-time in ad tech and fintech—including stints at Fast and Bond—he took a nights-and-weekends job at a wine store in NYC to pressure-test a thesis: that liquor stores were underserved by horizontal POS platforms.

What he found was worse than expected. Every day, five deliveries arrived with paper invoices. Staff spent roughly three hours manually keying that data into Square. Multiply that by 25 distributor relationships—the industry average, with high-end stores managing over 50—and you have a back-office workflow that’s practically begging for automation. He built an AI-powered receiving tool as a point solution, acquired ~20 customers in NYC, and within three months, six or seven of them asked for the same thing: “Can you just be our whole POS?”

Following YC and a small pre-seed gave them the early runway to start scaling and they’ve been heads down since. Santé launched its first POS customer in September 2023; by Q3 2024, the team closed 30 deals in a single month with zero feature requests — the clearest PMF signal a vertical founder can get. Today, a team of six AEs and three BDRs each close 20-30 deals per month through pure cold calling, with 95%+ retention driven by Santé’s position as the full system of record. Landmark wins include the highest-grossing liquor store chain in New York State, one of the top independent locations in California, and a PE-backed group in Massachusetts — all onboarded without product gaps. They’re 50 FTEs today and growing.

Darren’s 10-year target: MindBody-level dominance (50-60% share), which at projected ACVs with embedded fintech and AI would put the company at in IPO-scale valuation ranges.

A quick word from Parafin 👀

The Santé story makes the value of embedded vertical fintech clear. Our sponsor Parafin provides the infrastructure to embed lending, cash advances, and capital products directly into your vertical platform (or AI) — no banking license required. Click below to support Verticals and to learn how Parafin is helping thousands of founders like you.

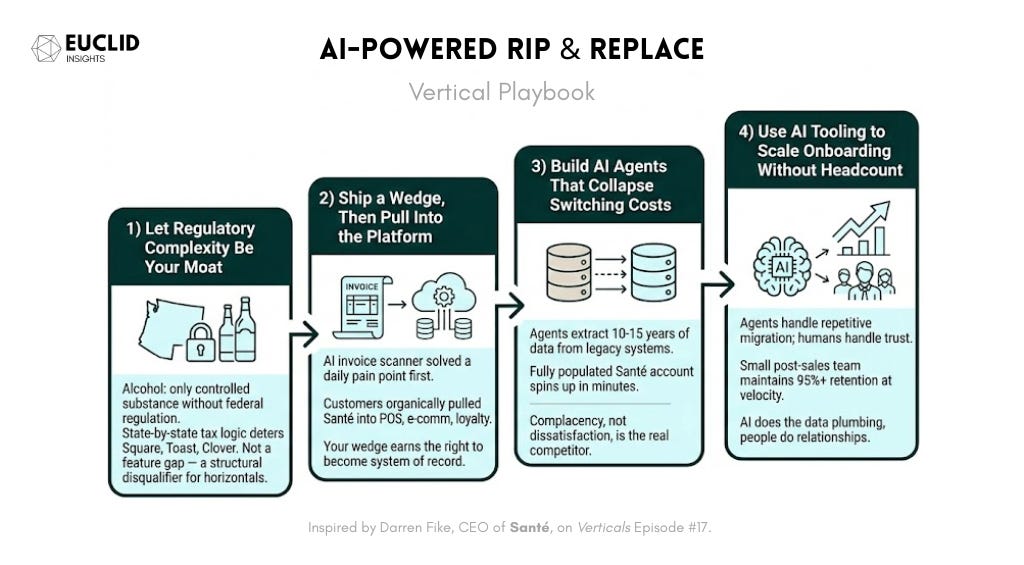

The Vertical Playbook: AI-Powered Rip & Replace

Step 1: Let Regulatory Complexity Be Your Moat.

Alcohol is the only controlled substance in the U.S. that isn’t federally regulated. Each state sets its own tax rules—carbonation-based taxes, county-specific delivery fees, bottle deposits—creating a compliance labyrinth that horizontal players like Square, Toast, and Clover won’t touch. As Darren frames it with a Gmail analogy: why would a platform serving millions of merchants throw off its core UX to accommodate tax logic that only matters to liquor stores? This counter-positioning is Santé‘s structural advantage. It’s not a feature gap; it’s a strategic disqualifier for horizontal incumbents.

Step 2: Ship a Wedge, Then Let Customers Pull You Into the Platform.

Santé didn’t start by pitching a full operating system. The AI receiving tool—scanning and digitizing paper invoices—was the wedge. It solved an acute, daily pain point with minimal adoption friction. But the pull toward platform was organic: customers needed POS, e-commerce, marketing, DoorDash/Uber Eats integrations, and loyalty programs all in one place. The lesson for vertical founders: your wedge earns the right to become the system of record. Don’t pitch the platform on day one.

Step 3: Build AI Agents That Collapse Switching Costs.

This is the centerpiece. Santé routinely displaces six to eight legacy systems. Five are industry-specific incumbents; several have recently been acquired by PE shops and are being sunset—creating what Darren calls “generational timing,” with over 26% of the market actively shopping. To exploit this window, the team built AI agents that crawl a prospect’s legacy system, extract all data—inventory, loyalty points, gift cards, 10-15 years of customer sales history—translate it into Santé‘s schema, and spin up a fully populated account. On a live demo, Darren drops a file onto a prospect’s server, triggers the bot, and minutes later says: “Here’s your Santé account with everything from your current system.” The result: switching anxiety evaporates. Sales cycles have compressed from 42 days to 23.5, with top reps closing under 18. The number one reason stores don’t switch, Darren notes, is complacency—not dissatisfaction. AI agents neutralize that inertia by making the cost of switching functionally zero.

Step 4: Use Internal AI to Scale Onboarding, Not Headcount.

The agents aren’t just a sales weapon. Post-sale, Santé supplements every onboard with scripts and agents that handle the repetitive migration work, freeing the (deliberately small) post-sales team to focus on relationship building and customer education. This is how they maintain 95%+ retention while onboarding at high velocity—AI handles the data plumbing, humans handle the trust.

The Takeaway for Vertical Founders

The conventional wisdom is that rip-and-replace is a structural headwind you manage, not a problem you solve. Santé flips that. By deploying AI agents as internal tooling—not just as the product—Darren has turned the industry’s highest-friction moment (migration) into his strongest sales asset. For any vertical founder staring down entrenched legacy incumbents, the playbook is clear: don’t just build a better product than the system of record. Build the tools that make leaving the old one painless. The switching cost moat only works if the other side can’t build a bridge. AI is the bridge.

For more on Vertical AI GTM strategies, explore our essays on Emerging Playbooks in Vertical AI and Vertical AI’s Integration Problem, or browse the GTM archive.