This episode is brought to you by Parafin — the embedded finance engine behind platforms like Amazon, Walmart, and DoorDash. Their AI model, trained on 1.8B data points from over 1.7m small businesses, powers fast, flexible financing that sellers can access directly within the platforms they already use. If you want to unlock a new revenue layer for your business, while actually helping your sellers grow, learn more about our awesome partner Parafin here.

Jefferies coined it the “SaaSmageddon.” In the span of weeks, $400B of SaaS enterprise value evaporated — the category’s largest non-recessionary drawdown in over 30 years. ServiceNow down nearly 50% from its peak. A penny stock that sells karaoke machines announced a freight AI product and triggered a double-digit sell-off across logistics software.

The bears say SaaS is dead. We disagree — AI is still software, and the market is expanding. But even if the pie grows, the league tables will look different. In a world where five to ten credible vertical AI competitors exist in nearly every category, the question isn’t will software survive — it’s who wins? History has a clear answer: distribution. There were a hundred Toast-like companies. One captured 50-60% market share — not with the best product, but with feet on the street.

In this episode, we dive into the SaaSpocalypse with Nick Tippmann, the Founder & Managing Partner of TipTop VC. TipTop is an Austin-based first-check fund investing in vertical software and AI. Previously, he was the founding CMO at Greenlight Guru (zero to eight figures of ARR, $120M PE investment). Tune in to hear Nick’s his view on the public market turmoil, his journey as an operator-turned-vertical-VC, and the GTM motions separating the best-performing Vertical AI founders in our respective portfolios.

This Week’s Guest: Nick Tippmann

From Founding CMO to First-Check VC

Nick grew up entrepreneurial in small-town Indiana — always wanting to start a business like his dad and grandpa. By his senior year at Indiana University, studying entrepreneurship, he realized the question he’d come to college asking (”how do you start a business?”) wasn’t specific enough. The real question was how to build a high-growth, venture-backed tech startup — and most of those words were foreign to a kid from rural Indiana. Then he discovered the early VC blogging wave: Brad Feld, Fred Wilson, Mark Suster, Paul Graham. Three out of four had been founders first, then became VCs. That planted the seed. For the next 14 years, he operated with a dual mindset: build something great as a founder, then eventually make the jump to venture.

The building phase was Greenlight Guru. Nick joined as technically the first employee and founding CMO of the medtech vertical SaaS, which helped medical device companies get FDA approval and stay compliant post-market. Over an eight-and-a-half-year ride, he wore every hat the company needed: marketing, rev ops, product (once PE came in), and eventually strategy and corporate development. That cross-functional grind — from demand gen to M&A — that cross-functional experience taught him what many VCs learn secondhand: go-to-market isn’t a department, it’s a system. Greenlight Guru scaled from zero to eight figures of ARR and attracted a $120M private equity investment before Nick moved on.

That move was TipTop VC, an Austin-based first-check fund writing $100-400k checks alongside leads like (our fund) Euclid. Nick’s LPs and supporters have experience across vertical winners like Toast, Shopify, Procore, ServiceTitan, Mindbody, and others — operators who’ve built and sold the exact type of company TipTop invests in. For Nick, that collective doubles as a proprietary diligence and support network, giving portfolio companies direct access to founders who’ve already navigated the vertical playbook. And he’s got some nice early breakouts in the portfolio, including GC AI, which went from $1M to $10M ARR in under a year and raised a $60M Series B at a $555M valuation.

Vertical Playbook of the Week

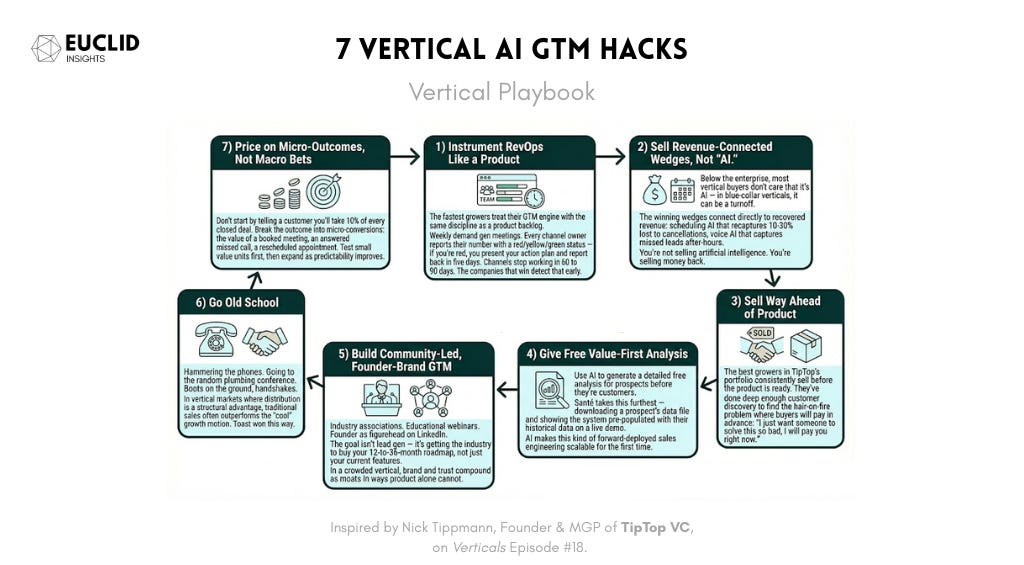

Roundup: 7 Vertical AI GTM Hacks

Step 1: Instrument RevOps Like a Product. The fastest growers treat their GTM engine with the same discipline as a product backlog. Weekly demand gen meetings. Every channel owner reports their number with a red/yellow/green status — if you’re red, you present your action plan and report back in five days. Channels stop working in 60 to 90 days. The companies that win detect that early.

Step 2: Sell Revenue-Connected Wedges, Not “AI.” Below the enterprise, most vertical buyers don’t care that it’s AI — in blue-collar verticals, it can be a turnoff. The winning wedges connect directly to recovered revenue: scheduling AI that recaptures 10-30% lost to cancellations, voice AI that captures missed leads after-hours. You’re not selling artificial intelligence. You’re selling money back.

Step 3: Sell Way Ahead of Product. The best growers in TipTop’s portfolio consistently sell before the product is ready. They’ve done deep enough customer discovery to find the hair-on-fire problem where buyers will pay in advance: “I just want someone to solve this so bad, I will pay you right now.“

Step 4: Give Free Value-First Analysis. Use AI to generate a detailed free analysis for prospects before they’re customers. Santé (a portco of Nick’s whose founder was a recent guest on Verticals) takes this furthest — downloading a prospect’s data file and showing the system pre-populated with their historical data on a live demo. AI makes this kind of forward-deployed sales engineering scalable for the first time.

Step 5: Build Community-Led, Founder-Brand GTM. Industry associations. Educational webinars. Founder as figurehead on LinkedIn. The goal isn’t lead gen — it’s getting the industry to buy your 12-to-36-month roadmap, not just your current features. In a crowded vertical, brand and trust compound as moats in ways product alone cannot.

Step 6: Go Old School. Hammering the phones. Going to the random plumbing conference. Boots on the ground, handshakes. In vertical markets where distribution is a structural advantage, traditional sales often outperforms the “cool” growth motion. Toast won this way.

Step 7: Price on Micro-Outcomes, Not Macro Bets. Don’t start by telling a customer you’ll take 10% of every closed deal. Break the outcome into micro-conversions: the value of a booked meeting, an answered missed call, a rescheduled appointment. Test small value units first, then expand as predictability improves.

The Takeaway for Vertical Founders

The SaaSmageddon panic assumes AI shrinks the software market. At Euclid — and on Verticals — we think it dramatically expands it; especially in spaces where digitization remains low and buyers are leapfrogging from pen-and-paper to AI-native platforms. But expansion doesn’t mean everyone benefits. Nick’s message is simple: there is no silver bullet. The companies emerging from this moment are winning because they instrument early, measure relentlessly, and execute the fundamentals with more discipline than anyone else. When product differentiation narrows and the market is in panic, distribution is the moat.

Thanks for reading Euclid Insights and for tuning in to Verticals! Drop us a line below with your thoughts. And don’t forget to subscribe to the show wherever you watch and listen.

Keep Reading

For more on the “SaaSpocalypse,” check out Euclid’s most recent essay — we analyze the recent public-market SaaS downturn and answer the question: is SaaS really dead?