Dude, Where's My Moat?

Evaluating long-term defensibility in Vertical AI

Abstract

1. Why Moats Matters

2. Is Speed a Moat in Vertical AI

3. Evaluating Prospective Moats

4. Framework for Building Defensibility

5. Planning Ahead for DefensibilityTo build a category-defining and enduring business, founders need strong defensive moats, which offer defensibility against competitors and clones. This has been the conventional wisdom in venture for decades. Some of the most successful technology businesses have compounding moats, wherein competitive advantage grows with the installed base. Why do moats matter? Because they’re about offense as much as they are defense. We like this description from Abraham Thomas:1

In warfare, moats are what prevent a castle from being stormed. In business, they’re what prevent a company from being overrun by competition, engulfment, or slow decay. Moats help you acquire and retain customers; they help you outperform and undercut rivals; they help you buy low and sell high, move fast and play bigger; they help you win, and keep winning.

Vertical software, in particular, has been a historical beneficiary of moats. We’ve written in the past about the stickiness that comes with dominating an industry ecosystem. These effects don’t always show up in net retention rates: while mid-stage vertical platforms do outperform their horizontal peers, churn compared to horizontal SaaS peers tends to be comparable on average. A more significant indicator of vertical moat potential is long-term revenue persistence—public vertical SaaS businesses are, on average, 6 years older, 30% more profitable, and significantly more likely to be multi-product platforms.2 Dominant companies, such as Autodesk, AppFolio, or Tyler Technologies, have relied on industry-linked moats for decades. Just as notable are the numerous high-retention, low-NPS Vertical SaaS companies that remain today.

Today, the SaaS ecosystem—whether vertical or otherwise—faces a moment of existential doubt. LLMs have made some past moats obsolete. Moreover, AI startups that have experienced rapid early growth will need to find defensibility in a world where capital is flooding into fast followers and AI products have seen “tire-kicking” behavior from buyers (leading to pronounced churn in early consumer & prosumer LLM tooling). Startups and their backers are, reasonably, wondering what it takes to build a defensible business in 2025. While tactics change, we believe the basic sources of a moat will remain unchanged:

In our view, Vertical AI that can graduate into a lasting platform will need to do more than innovate at a single layer of the customer value chain. At Euclid, we believe the immutable primitives of software defensibility are workflow and data (see more in our essay, “Emerging Playbooks in Vertical AI”).

In today’s piece, we’ll evaluate emerging viewpoints on defensibility in Vertical AI and share our developing perspective on the future of moats.

Speed is the Moat (Until It Isn’t)

Some believe velocity is the only moat that will survive AI. The ability to build, ship, iterate, and adapt at a rapid pace has always been a reliable hallmark of the best, most durable companies. Thanks to LLMs, this effect is amplified: MVPs can be launched and cycled quickly; underlying advancements in foundation models are “free” to the application layer; and those teams willing to master cutting-edge AI tools internally will gain an edge. Fast teams learn quicker. They attract better talent. They course-correct in real time. Jamin Ball from Altimeter covers this perspective well here:

Execution speed. Hiring speed. Firing speed. Distribution speed. Even decision-making speed. You don’t win because you’re defensible, you win because you’re faster. Killing bad ideas is just as important as the speed of executing against good ones. The opportunity cost of time has never been greater.

NFX shared the view in their missive, Speed and AI, that early startup success is no longer a matter of multi-year cycles. The new paradigm, they argue, is execution in weekly (or even daily) feedback loops. Teams will be measured in RPMs.3 Regardless of your metaphor for it, speed delivers increasingly essential advantages:

Learning Loops: More iterations mean more data, faster insights, and tighter product-market fit.

Talent Magnetism: High-velocity environments attract top performers who want to make a visible impact.

Market Gravity: Speed Can Drive Brand Buzz. Buzz can attract customers, integration partnerships, and of course, investor sentiment & capital.

Internal AI Acceleration: Expertise in adopting, mastering, and applying bleeding-edge AI tooling that supports faster development and internal automation has become a discipline in itself.

All that said, is speed truly a durable moat? The ability to maintain organizational foresight, flexibility, and innovation over time—world-class execution that outruns and outthinks competition—is, of course, the ultimate advantage. One might argue it’s not a strategic moat per se, in that it’s innate, impossible to devise strategically. But setting those semantics aside for a moment, I think we can argue persuasively that it is not a durable advantage. At scale, almost all companies slow down to service a large and heterogeneous customer base; competition and fast followers begin to gain absolute scale of their own; old breakthroughs become commoditized; demand for cash flow grows; and organizational torpor suffocates innovation.

The graveyard is full of startups that moved with resounding early pace, “defined their market,” but in the end—lacking durable moats—were overcome. Whether their moment in the sun lasted five days or five years, companies like Lotus Notes, Siebel Systems, MySpace, Domo, Box, Sidecar, Zenefits, Hopin, and Lensa demonstrate that speed at a discrete moment in time is less important than the ability to keep growing strongly over time. And that’s where moats come in.

Evaluating Moats for Vertical AI

No formula in finance tells you that the moat is 28 feet wide and 16 feet deep. That’s what drives the academics crazy. They can compute standard deviations and betas, but they can’t understand moats.4

To gain a comprehensive understanding of how defensibility is evolving with AI, we examined every type of moat, both pre- and post-AI. In the table below, we list each type, a brief description, its significance in the AI era, and its strength (considering stage and relevance) for Vertical AI. Like in our analyses on product-market fit and TAM, semantics here are always a challenge. Reading various sources, the term moat seems to describe everything from long-term economic moats to barriers to entry to “things VCs like early-stage startups to have.” In the distillation below, we list the fourteen strains that have the potential to serve as competitive advantages in at least one phase of a Vertical AI business (please refer to the two-page table).

In his piece Data and Defensibility, Abraham Thomas (Quandul co-founder) proposes two types of moats for the AI-native company, both data-centric. “Data moats reinforce AI advantages,” he writes, “and AI advantages reinforce data moats.” The two moats are:

Data Control: Proprietary control of a data asset that others can’t simply replicate—be it due to uniqueness, fragmentation, method of aggregation, specialized analysis required, etc. Synonymous with Data Gravity above.

Data Loops: Positive feedback loops that compound advantages. These moats often center around workflow, usage, and network effects.

For Vertical AI startups thinking ahead on moat, the logical product wedges will target workflows that lend naturally to data loops. With, of course, the end goal of building data gravity. In considering target workflows AI-native wedges can address, we look for three critical ingredients:

Serving as the authoring layer (i.e., launch point) for a high-value workflow, with natural extensibility to other functions in the process.

Following a product roadmap aligned with that essential workflow, ideally unlocking revenue from day one.

Becoming the highest engagement tool in its domain, using data loops to build into key moats over time.

The success of a Vertical AI wedge isn’t necessarily aligned with long-term defensibility. Such products should strive to minimize friction as much as they maximize time-to-value. They can serve as a standalone “tool,” initiating a workflow without any initial platform play. Along with low friction comes low switching costs. As such, startups must leverage the distribution from their beachhead product to build long-term staying power.

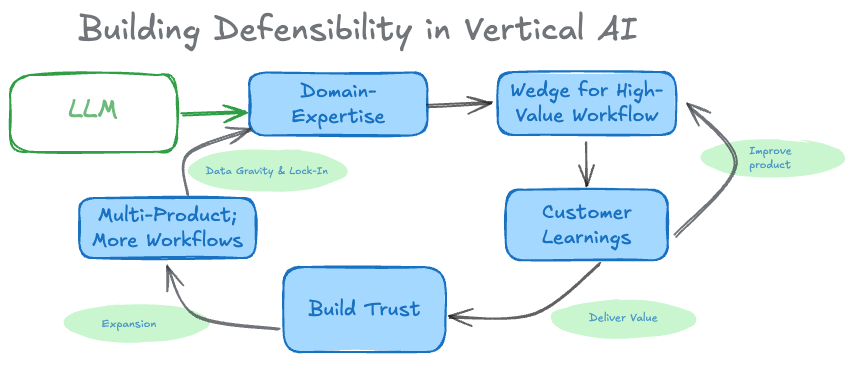

Successful startups will leverage early moats—such as product usage, first-party data, and customer trust—to quickly create a data loop. Here are the steps that we see for building a data moat over time, combining deep domain experience, customer learnings, proprietary data, trust, and usage:

Leverage LLMs to drive a “previously impossible” outcome at a key point in a vertical-specific, high-value workflow.

Incorporate customer learnings to improve product, deliver value, and gain trust of industry stakeholders.

Leverage that trust to expand into multiple products and tackle additional workflows.

Repeat as necessary & build long-term lock-in.

Each time a new product is launched, it benefits from growing platform lock-in, but is still exposed to a relative lack of usage data loops. The core products, however, hopefully continue to accrue defensibility. Some express this form of moat-widening over time as the motte-and-bailey approach: Your core offering is the castle on the hill; your new modules or agents are your walled village, capable of flexibility without compromising its integrity.

This, of course, is not the only way to build a moat, nor does it incorporate all possible moats. It’s simply an archetype of early success that we are beginning to see in Vertical AI. We’ve written extensively on this in the past, describing our take on the System of Intelligence:

Another, more transformation competitive advantage lies in creating new “intelligent” systems of record leveraging first-party data an AI-first vertical product captures. The Authoring Layer is foundational to the System of Intelligence because it begins by taking over the data entry step. In doing this, we understand what a proper data object looks like. The platform can proceed, however, to understand what data entries are desired, why, and when a business owner needs to know about then.

The System of Intelligence model, of course, is a System of Record reimagined for the age of AI. Some may replace an existing system of record over time, as it builds a parallel data store, replaces many key pieces of functionality, and ultimately makes the legacy system of record redundant. In other cases, it may leapfrog SoRs, defining new categories of its own. In either case, the result is a business with increasing defensibility and high switching costs thanks to data gravity.

Don’t Build a Castle Without Leaving Room for a Moat

Vertical AI startups are reporting some incredible growth rates, especially per dollar burned. Despite its shortcomings as a moat per se, such speed is a compounding advantage in the early days of a category. That even might be truer today where AI leapfrogs industry barriers to SaaS adoption, opening up blue-ocean budgets ripe for the taking. That doesn’t mean, however, that more traditional moats are irrelevant. It’s important to remember that we are in the very early innings of Vertical AI. Commoditization will eventually come for all startups, perhaps faster so in the post-AI era… making long-term moats doubly critical to consider.

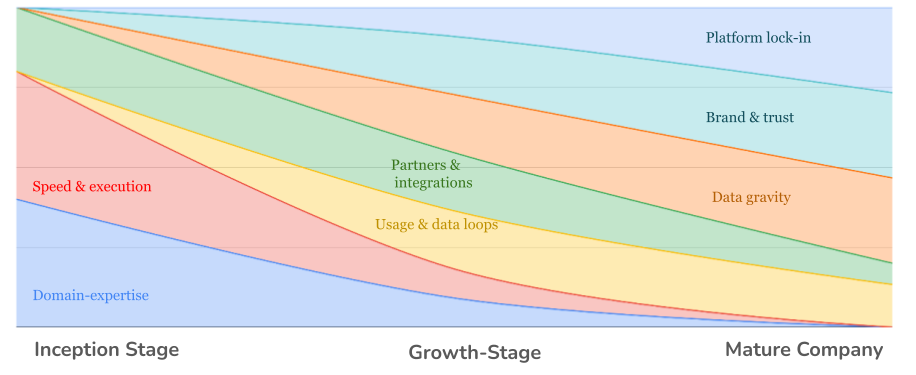

In the chart above, we (subjectively) evaluate the relative importance of various moats for Vertical AI, based on the stage of the company. At the inception stage, most advantage derives from moats that quickly degrade: domain expertise and speed & execution. Partnership and integration relationships are a durable moat, but one that becomes less relevant at scale. The most critical moats at the growth stage are usage and data loops, as we described above. In all likelihood, we believe that a defensible Vertical AI business at scale would have, at minimum, moats in data gravity, brand & trust, and/or platform lock-in.

We believe it is mission-critical for modern startups to build toward durable moats—and that this path should begin with a falsifiable, living hypothesis made in the earliest days of a company's life. Commoditization being hard to anticipate, waiting too long to determine & invest in moat(s) is a mistake. Consider an analogy from our friend, Eric Ver Ploeg: would you invest in a wheat farm?

Proven gigantic TAM. Incumbents are old and slow moving. Market will continue to grow into the future. Our team has deep domain knowledge… But, when the offering is a startup’s new software product rather than wheat, founders usually fail to consider the fact the future competitive landscape might look very different from what it does at the outset. Perhaps this is because a future commoditized industry is less obvious than a current commodity industry.

At a minimum, mapping out the necessary steps on the defensibility journey from the outset forces health strategic thinking. Everyone knows that no such grand visions are possible without first achieving product-market fit and winning your beachhead ICP. And yes, speed is non-negotiable.

That is why, at Euclid, we like to think big but start small. Let’s combine the takeaways above into a simple framework for building towards defensibility in Vertical AI:

Leverage domain expertise to build an easy-to-adopt AI wedge fine-tuned for a vertical.

Drive adoption of the wedge and iterate quickly with customer learnings to improve product, deliver discrete value to customers, and build trust with stakeholders.

Leverage early distribution advantage, customer trust, and first-party data to expand into additional workflows.

Repeat as necessary to expand into multiple products.

The authoring layer wedge serves the base unit for a new (or replacement) system of record, targeting moats in data gravity, brand & trust, and/or platform lock-in.

For most startups, much of the above path likely begins in earnest only after securing Series A funding. Regardless, we recommend that founders begin crafting the narrative from the start, identifying the likely path(s) to defensibility, considering expansion product(s), and rationalizing the choice of a wedge product. As we wrote in our guide to Vertical Market Sizing, an early-stage team should stay focused and insulated; however, a CEO should always be able to define the long-term strategic vision, including moats.

Thanks for reading Euclid Insights! If you know a founder who is thinking through Vertical AI moats, we’d love to help. Just reach out via LinkedIn, email, or here on Substack (via comments or the DM button below).

Thomas (2025). Data and Defensibility. Pivotal

Bowery Capital (2021). Vertical SaaS: What Is It & How Is It Different? Bowery Capital.

Rotations per Minute, but in this case referring to number of times you can perform iterative testing / improvement cycles per period.

Buffett (1999). Berkshire Hathaway Annual Shareholder Meeting. Berkshire Hathaway.

This was excellent. One thing I’ve been thinking about is how the wedge to platform path is shifting under AI acceleration.

The playbook still holds: start focused, earn trust, expand. But the timeline feels compressed. AI is accelerating product cycles, raising user expectations, and increasing the risk of commoditization. The window to make the leap is narrowing. A great wedge doesn’t buy as much time as it used to.

At the same time, building a durable and trusted platform still takes time. I don't think AI lets you shortcut your way 100% there. Which makes timing even more important. You have to ship something narrow enough to drive adoption, while also mapping the platform arc and execution path early enough to create real defensibility.

This is a great one. Congratulations!